The landscape for center store beverage categories has been shifting dramatically, as consumers have gravitated toward drinks that provide functional benefits beyond thirst quenching and a caffeine boost.

Increasingly, these functional ingredients — from antioxidants to electrolytes, collagen and others — are being incorporated across various beverage sub-categories, including bottled waters, ready-to-drink (RTD) coffees and teas, and fruit and vegetable juices.

“There’s just been a tremendous amount of blurring,” said Sally Lyons Wyatt, executive VP and practice leader at Circana. “We have seen beverages morph itself into this spectrum of options for consumers.”

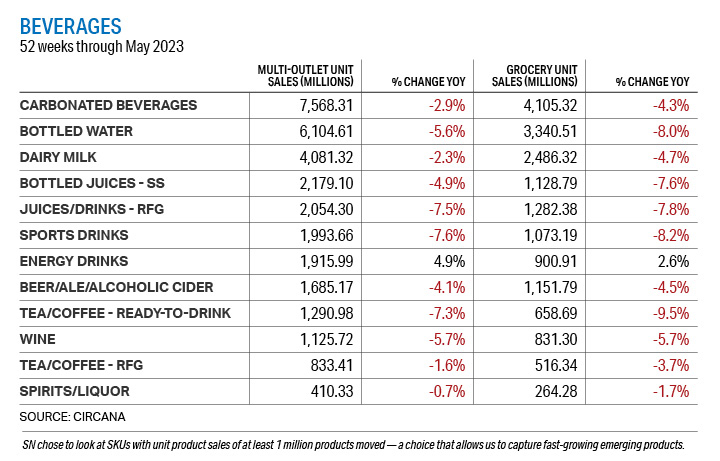

Many of the beverages tracked in this year’s Category Guide followed the pattern of most other center store products, with dollar sales up sharply amid inflation, and unit sales down, as consumers adjusted their shopping habits.

Some subcategories deviated from this pattern, however, including energy drinks, which saw dollar sales rise 13.4% in the grocery channel in the past year — leading all other beverages — as well as unit sales growth of 2.6%. All other major beverage categories saw unit sales declines in the past year.

“Energy drinks have had a great ride,” said Lyons Wyatt, who noted that these beverages are particularly popular among Gen Z consumers.

Innovative new formulations from energy drink makers are contributing to the sales of these products, as is their prevalence on social media, especially TikTok, she explained.

Tabitha Sewell, director of category management at KeHE Distributors, agreed that consumer interest in health and wellness was having a significant impact on beverage category sales. She cited the popularity of wellness shots, for example, as well as added vitamins in beverages, and other functional ingredients such as protein and collagen.

In addition, sugar alternatives such as Stevia, monk fruit, and allulose have emerged as popular options for consumers who want to avoid sugar and still enjoy something sweet, she said.

Lyons Wyatt said she expected the blurring between categories in the beverage aisles to continue, as more types of beverages incorporate functional ingredients.

“The base may be a coffee, but there will be more functional coffees,” she said, citing the recent rollout of Starbucks coffee infused with olive oil as an example. “I think that’s just the way in which we’re going to see things unfold.”

RTD coffee and tea, meanwhile, saw the biggest decline in unit sales among the major beverage categories, with volumes down 9.5% in grocery, and dollar sales up only 2.4%.

The trend toward health and wellness is also impacting the adult-beverage categories, Sewell of KeHE noted.

“RTD nonalcoholic beverages are seeing growth in the adult-beverage section of the store as a healthier option,” she said.

Circana data showed that beer, wine, and spirit sales were all down in both dollar sales and units in the past year.

Grocery retailers, meanwhile, have increasingly sought to capture more share of the adult-beverage business with items such as RTD cocktails and private-label wines.

Albertsons, for example, last year added the premium Vinaforé Collection to its private-label wine assortment, joining the retailer’s Signature Reserve, O Organics and Kalyana private brands in the wine category.