There’s plenty of evidence that private label gained a lot of ground during the recession. In some channels, and some regions of the country, it continues to, due to the sluggish pace of the recovery. Despite what the government says, there are plenty of people out there who are still watching their budgets.

Retailers, of course, have conflicting emotions. National brands bring in huge promotional allowances that go straight to the bottom line; likewise, they generate loyalty, particularly if they’re iconic names like Coke or Quaker Oats.

On the flip side, private label is all theirs. They set the specs and reap all the profits. And loyalty? Store brands help connect the product directly to the store in the mind of shoppers, particularly if they know the item isn’t available anywhere else.

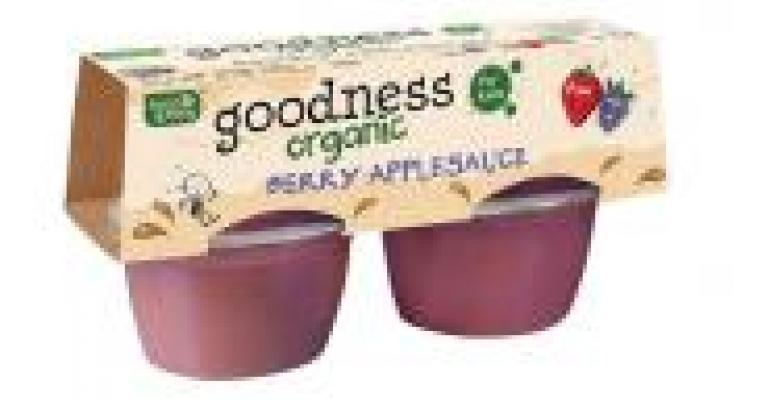

Fresh & Easy Neighborhood Market knows this. This week, the 168-store, Tesco-owned chain rolled out fresh&easy Goodness, a line of better-for-you products just for kids. Choices include peanut butter, juices, macaroni & cheese, pasta and cereal.

Fresh & Easy Neighborhood Market knows this. This week, the 168-store, Tesco-owned chain rolled out fresh&easy Goodness, a line of better-for-you products just for kids. Choices include peanut butter, juices, macaroni & cheese, pasta and cereal.

“Like all fresh&easy [brand] products, there are no artificial colors, flavors or preservatives, no added trans fats and no high-fructose corn syrup,” stated chain officials in a press release. “Fresh & Easy also worked to limit the amount of sugar, sodium, and fat in fresh&easy Goodness products and has made sure the products contain no artificial sweeteners and no added caffeine.”

Fresh & Easy has built itself on private label, as has Trader Joe’s, Aldi and other small-format competitors to full-service supermarkets. And that’s where there’s been consistent buzz — and growth — these past few years. None other than Consumer Reports magazine has published articles comparing private label and national brand products. Of the 29 food categories tested, the national brand was the winner in only six. What’s more, the tested store brands cost 27% less on average than the national brands.

The above was mentioned in a new report from the folks at Deloitte that profiles the battle for brand loyalty. The study notes that, “Many consumers increasingly sense a diminishing discrepancy between the quality of national brands and their private label counterparts as retailers sharpen their focus on store brands and garner loyalty, and consumer product companies cede connections to retailers and increasingly knowledgeable customers.”

The report quoted SymphonyIRI data to back it up: Private labels currently represent 20% of supermarket and 18% of supercenter sales. These products were 31% cheaper, on average, than their national brand counterparts.

The big question — which I suspect won’t be definitively answered for quite some time — is what happens now? As the recovery spreads and touches more households, will brands bounce back? Or will store brands maintain their market share?