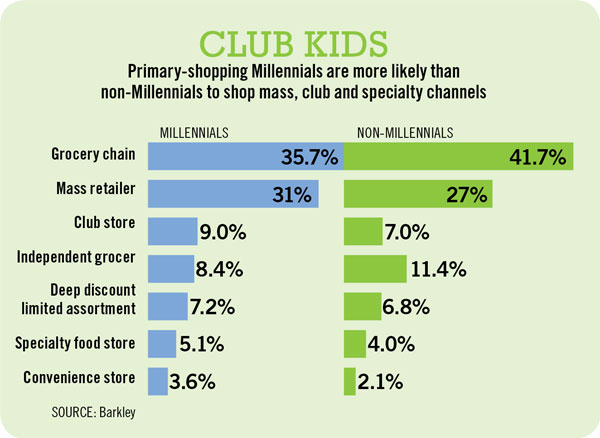

The Millennial generation is coming of age at a time when most grocers are fixed on the opportunities presented by big-spending Americans born during the post-World War II baby boom. But in five short years their sons and daughters, ages 17 to 34, will outspend their parents and every other generation. Traditional food channels have some catching up to do considering that Millennials are less likely than non-Millennials to shop grocery chains.

SN convened an expert panel to discuss the most effective ways for retailers to ingratiate themselves to this important consumer group. Participants were Judy Spires, president and chief executive officer of Kings Food Markets; Tom Monahan, marketing manager for PCC Natural Markets; Michelle Fenstermaker, executive director, insights for WD Partners, a design and management company for food and retail brands; Brad Hanna, senior vice president, group account leader for Barkley ad agency; and Malcolm Faulds, senior vice president of marketing for BzzAgent, the social marketing arm of Dunnhumby. SN’s Center Store editor Julie Gallagher moderated.

SN: What opportunities do Millennial shoppers present to retailers?

Kings Food Markets’ Spires: The Millennial shopper is extremely important to our brand and we’ve made a conscious decision to target this customer. They’re in the process of setting up their lives and we want to be there in that process. So our whole brand is geared toward that. What do Millennials want? Fresh, they want local, they want organic, they want new and exciting spices and foreign-based dishes. They want to be able to be the first to taste them and tell their friends about them.

Kings Food Markets’ Spires: The Millennial shopper is extremely important to our brand and we’ve made a conscious decision to target this customer. They’re in the process of setting up their lives and we want to be there in that process. So our whole brand is geared toward that. What do Millennials want? Fresh, they want local, they want organic, they want new and exciting spices and foreign-based dishes. They want to be able to be the first to taste them and tell their friends about them.

BzzAgent’s Faulds: I would just echo something that Judy mentioned about wanting to understand what products these consumers want to recommend to their peers. Understanding the behaviors and motivations of these consumers when it comes to digital and social media is a great predictor of where things are headed and when we tap into how these consumers behave, they do over-index in their use of mobile technologies, smartphones, the web, social media sites and it’s interesting to see that they will be brand advocates for a specific product that they think is noteworthy. They’re interested in part by altruism; they want to make recommendations that they think other people will benefit from. They also are somewhat driven by ego; they want to be seen as the person who is in the know or the one who is able to tap into the next great thing.

BzzAgent’s Faulds: I would just echo something that Judy mentioned about wanting to understand what products these consumers want to recommend to their peers. Understanding the behaviors and motivations of these consumers when it comes to digital and social media is a great predictor of where things are headed and when we tap into how these consumers behave, they do over-index in their use of mobile technologies, smartphones, the web, social media sites and it’s interesting to see that they will be brand advocates for a specific product that they think is noteworthy. They’re interested in part by altruism; they want to make recommendations that they think other people will benefit from. They also are somewhat driven by ego; they want to be seen as the person who is in the know or the one who is able to tap into the next great thing.

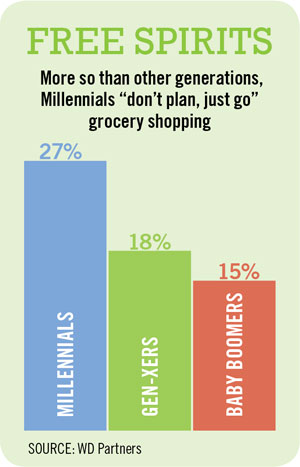

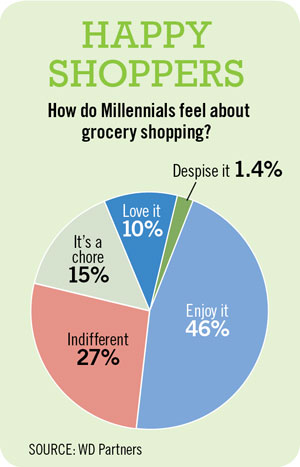

WD Partners’ Fenstermaker: In terms of opportunities for Millennial shoppers in the grocery channel, they love shopping more so than other generations based on a study we’ve done and this extends even into food shopping. One big “aha” that came out of our study is experience trumps convenience. So here’s a generation that’s very much into retail in terms of providing them an experience rather than a choice because quite frankly grocery shopping is the most frequent type of shopping you’ll probably do in your lifetime and they enjoy it today. Now whether that’s a life stage issue or not, time will tell but they’re craving experiences.

WD Partners’ Fenstermaker: In terms of opportunities for Millennial shoppers in the grocery channel, they love shopping more so than other generations based on a study we’ve done and this extends even into food shopping. One big “aha” that came out of our study is experience trumps convenience. So here’s a generation that’s very much into retail in terms of providing them an experience rather than a choice because quite frankly grocery shopping is the most frequent type of shopping you’ll probably do in your lifetime and they enjoy it today. Now whether that’s a life stage issue or not, time will tell but they’re craving experiences.

Spires: Millennials are also known as the Echo Boom, they’re the sons and daughters of the Baby Boomers so therefore the largest generation yet and they really influence the Boomers. So the Boomers want to stay young and hip and if we put something out for the Millennials — say, for example, a health-conscious and new texture driven kale salad — it’s amazing how many Boomers are standing in line because they want to be young and hip just like their kids. It’s a very interesting phenomenon.

PCC Natural Markets’ Monahan: If you look at that age group, the tail end, some are starting families and childhood nutrition is a big, big deal for PCC. So you see a lot of young mothers trying to feed their kids with healthy food and they’re just trying to determine what exactly they’re feeding their kids. So it’s a big group but towards the end of that 17-to-34-year-old group families are a big area of opportunity.

PCC Natural Markets’ Monahan: If you look at that age group, the tail end, some are starting families and childhood nutrition is a big, big deal for PCC. So you see a lot of young mothers trying to feed their kids with healthy food and they’re just trying to determine what exactly they’re feeding their kids. So it’s a big group but towards the end of that 17-to-34-year-old group families are a big area of opportunity.

SN: Can you talk about the features or services that you’ve developed in response to Millennial habits or trends?

Spires: The Millennial is used to getting immediate information so we’ve redesigned our website, our email communications, Facebook, Twitter — all aimed at giving the kind of immediate information that the Millennial is looking for. We have QR codes throughout the store and in our communication pieces so they’re very comfortable scanning the QR code, getting the information and learning more of the story. We’ve also expanded our service departments, going back to all service meats and service seafood because Millennials are very interested in sustainability and sourcing and about the products as well as how to prepare them. We have a cooking school that gives the opportunity to take it a little deeper and enjoy the ability to experiment with a lot of the new tastes that are coming from different countries that haven’t really been mainstream in our diets, but the Millennials are jumping on every opportunity.

Monahan: It sounds like Judy and I work for the same company. PCC has done a lot of similar things as far as Facebook, Twitter, Pinterest and through those avenues sharing features like What’s For Dinner Tonight? on a daily basis, recipes on a daily basis and product information. Like Judy said, Millennials want to know how to prepare it and they want to know more information about it. We just launched a mobile website which is good for smartphones and the smaller tablets. As far as product offerings, you can look directly at the service or fresh departments and in the deli specifically there are a lot more grab-and-go features like sandwiches and salads and more take-and-bake options like pizzas and casseroles, just because the lifestyle is busy and they’re looking for easier options.

Monahan: It sounds like Judy and I work for the same company. PCC has done a lot of similar things as far as Facebook, Twitter, Pinterest and through those avenues sharing features like What’s For Dinner Tonight? on a daily basis, recipes on a daily basis and product information. Like Judy said, Millennials want to know how to prepare it and they want to know more information about it. We just launched a mobile website which is good for smartphones and the smaller tablets. As far as product offerings, you can look directly at the service or fresh departments and in the deli specifically there are a lot more grab-and-go features like sandwiches and salads and more take-and-bake options like pizzas and casseroles, just because the lifestyle is busy and they’re looking for easier options.

Ways retailers and CPG companies are catering to Millennials

Spires: Theirs is a busy lifestyle but they still want to eat healthy and in our new stores we’re offering grain bars and flatbread pizzas made with wholesome ingredients that cook in front of you in two minutes and allow customization, which is another aspect of the Millennials. They’ve been used to customizing everything from their book bags to their sneakers so it just carries over.

Faulds: The gentleman from PCC mentioned the portability of food. One of the things we look at is what foods are generally buzzed about and how that ties to their retail sales. Some of the most buzzed about products are very portable. They are packaged in a way that makes them single serve or just more efficiently handled. K-Cups are huge this year and that space has just exploded. Tide Pods are another one of the most buzzed about products this year.

Cooking and Food Preparation

SN: Judy, you said it’s important to educate members of Gen Y on cooking and food preparation. Is this an area that they’ve expressed interest in?

Spires: It’s something they’re very interested in, but not in a formalized didactic way. They want to discover it on their own. They want to be the ones who know the secrets. So with QR codes and the stories behind the product we’ve created that treasure hunt for the Millennials in helping to educate them in a very subtle way so they are the finders of the good stories to tell and are raving fans to spread the word first.

Fenstermaker: One of the things we found in our research is exactly what Judy is saying: They want their grocery stores to inspire them. If there was a key takeaway it was all about inspiration and information at the point of sale coming at them in ways they can easily access that allow them to really control that experience. They want to be inspired to try new recipes, put different foods together and are really desiring the grocery store of the future to be able to provide that for them.

Spires: You know, Michelle, I think you must’ve written my whole marketing campaign because that’s exactly what our tagline is: “Kings, Where Inspiration Strikes.” It’s so amazing to have that verified again, thank you.

Spires: You know, Michelle, I think you must’ve written my whole marketing campaign because that’s exactly what our tagline is: “Kings, Where Inspiration Strikes.” It’s so amazing to have that verified again, thank you.

Barkley’s Hanna: For every generation that has come since the silent generation we’ve had declining cooking skills and Generation X was about as bad as it could be. In our study where we talked to almost 4,000 Millennials, the number who said that they loved to cook, considered themselves an expert cook or enjoyed cooking and being a creative cook was significantly higher than the non-Millennial audience and because of this down economy they’re doing more entertaining, experimenting through adventures with food and they’re absolutely looking for grocery stores to inspire that.

Barkley’s Hanna: For every generation that has come since the silent generation we’ve had declining cooking skills and Generation X was about as bad as it could be. In our study where we talked to almost 4,000 Millennials, the number who said that they loved to cook, considered themselves an expert cook or enjoyed cooking and being a creative cook was significantly higher than the non-Millennial audience and because of this down economy they’re doing more entertaining, experimenting through adventures with food and they’re absolutely looking for grocery stores to inspire that.

SN: Do Millennials need to be convinced that supermarkets are relevant to their needs?

Fenstermaker: When we talk about supermarkets I think we need to understand how they categorize supermarkets. We found that traditional grocery stores are No. 3 on their ideal place to shop for groceries. What they were looking for was, No. 1, the supercenters, followed by specialty stores, followed by traditional grocery stores and we don’t know if that’s a life stage issue. That’s one thing when you do Millennial research. What things are sticking points with this generation and what things will morph and change as they go through these different life stages? They’re the most likely generation who has come along in a long time who is actually creating grocery budgets compared to maybe Baby Boomers. So supercenters offer that to them. Specialty stores [are attractive] more from the experiential standpoint so that’s one of the things that we found out will be critical for traditional grocery stores moving forward.

Spires: I saw a little bit of different research that shows the supercenter usage going down in their quest for fresher, natural, organic offerings.

Fenstermaker: We definitely saw that because they value that fresh food offering and even the sensorial aspect of fresh that the supercenters aren’t able to pull off and the thing that we were finding with supercenters was just more of that simplified pricing. They don’t want to fight for a club price vs. this is if I carry a loyalty card vs. what the manufacturer might be offering and the retailer’s 10 for $10. Just the fact that it’s very simplified pricing and in their life stage, one stop shop is highly valued. So it speaks to being able to give them everything they need in one place.

Fenstermaker: We definitely saw that because they value that fresh food offering and even the sensorial aspect of fresh that the supercenters aren’t able to pull off and the thing that we were finding with supercenters was just more of that simplified pricing. They don’t want to fight for a club price vs. this is if I carry a loyalty card vs. what the manufacturer might be offering and the retailer’s 10 for $10. Just the fact that it’s very simplified pricing and in their life stage, one stop shop is highly valued. So it speaks to being able to give them everything they need in one place.

Hanna: We also found that same issue in our study — that when you look at primary Millennial grocery shoppers as a group, they are 13% more likely [than non-Millennials] to shop at a mass retailer, 36% more likely to shop at a specialty food store. They’re actually 17% less likely than non-Millennials to shop at a traditional grocery store. What’s interesting is that when you get into them adding kids to the household, Millennial moms certainly still relied on the mass retailers as a larger percent than the non-Millennial group but specialty stores actually decreased. They were 4% less likely to shop at specialty.

SN: It sounds like they’re willing to pay a premium for specialty foods, things like natural, organic, gluten-free and maybe vegan foods?

Spires: As long as they consider it a value. They’re not going to pay an unrealistic price, but they understand that there is a premium on higher quality.

Fenstermaker: Definitely the value and it can be very aspirational for Millennials. They know they want to get there and when their budgets allow them they talk about how they’d like to purchase more of that but I think also they’re looking for these grocery retailers, whether or not they choose to purchase natural or organic, where the offering is wide enough and broad enough and varied enough to meet their needs when they choose to do that.

Hanna: We found that Millennials are actually very savvy shoppers in this way. Over 60% feel that store brands are a better value for the money and over 60% think they are just as good as a name brand so they understand the value, but on the flipside 72% think store brands are good for some items and not others and over half really look for brands that reflect their style or personality. The Millennial shopper knows and evaluates every product and category and brand based on where am I going to get quality at a good price and there is a lot of products where private label or other value brands are certainly fine and others that I just don’t trust.

Evolving Communications

SN: How is the communications landscape changing with Millennials?

Hanna: It’s probably one of the most significant changes for marketers. It’s funny because a lot of CPG marketers look at television and certainly TV is a predominant medium to reach this Millennial audience. However, how they’re watching TV is significantly changing. They’re watching less real-time or live TV and watching more — as a difference between non-Millennials — on the computer and on DVR and On Demand, so even traditional media is changing. But over 50% want to be the very first to try new technologies and what’s happening is where generations in the past have looked for credible experts with real world experience around products or categories. This audience is trusting the ratings and reviews and even sending out to their social networks to get approval on things and creating the conversations that are changing the dynamic of how brands are perceived within that peer-to-peer recommendation, which has never been there before.

Faulds: Yes, I think that is an interesting trend that we’re seeing and it actually runs counter to some of the discoveries that people were talking about before. There is discovery pre-store vs. in-store with a lot of people sharing product ideas and recipe ideas with shoppers before they get to the store. In some cases maybe pre-empting some of the serendipity or discovery that happens in-store.

Faulds: Yes, I think that is an interesting trend that we’re seeing and it actually runs counter to some of the discoveries that people were talking about before. There is discovery pre-store vs. in-store with a lot of people sharing product ideas and recipe ideas with shoppers before they get to the store. In some cases maybe pre-empting some of the serendipity or discovery that happens in-store.

Hanna: And when it comes to that communication we really see that all brands and retailers need to start looking at a new paradigm. The old model was simple communication and for Millennials it’s about creating engagement. We used to just look at the heavy users, now we’re looking at the heavily engaged participants. We used to just try to make big promises, now Millennials are looking for personal gestures. We used to look at users as just passively receiving our message, now we have to look at them as active co-creators and the way we’re going to go about planning communications to engage this audience. They already are in most brands’ core target into the mid-30s, but brands and retailers are really going to have to change how they approach communications because of the way they’re engaging differently.

Monahan: This is directly reflective of some of the planning we’ve been doing lately and we’ve been doing this for quite a few years now but we plan out our website and what we’ll feature on the home page for months in advance and as of late we’ve been tracking more specifically what’s happening in real time and what’s trending on Facebook or Twitter. We’re looking at food topics in particular and what’s trending. So coconut oil for instance. We’re trying to be more aware real time and we’re trying to react real time. So looking at that two-month calendar we almost mock it now to the point where we say we have to prepare to put information on our site that day, that second, because people are responding so quickly to things now.

Hanna: That is a huge point about brands living in the here and now. It’s something that absolutely is going to have to change and that’s just a great comment.

SN: Should marketers be courting influential users of social media since this generation is more likely to use the Internet as a platform to broadcast thoughts and experiences?

Faulds: Influential is a funny word and there are some people like Klout who’ve really made it a popular term. I’d say that brands need to look for the right consumers to engage with. Someone who is too influential might be hard to get ahold of or to get them involved and then someone who is not influential is not going to create the peer influence you’re looking for. So what I mean is brands should look for people who will participate and when they participate they will reach other people and those people will react. Basically they should score people on their effectiveness as brand advocates and there are some basic elements that go into this kind of a scoring exercise but are they people who when invited to take part in something participate? Do they participate with high-quality testimonials or product reviews, photos or videos that are appropriate, and when that content is shared does it create action? So if people post a review to Facebook does anybody like it, share it or comment on it?When people post a review on a retailer’s website do other people like that or respond to that review? So instead of just looking for influence it might be the wrong metric. I think you’re looking for influence paired with a willingness to participate or getting involved with a particular brand.

Faulds: Influential is a funny word and there are some people like Klout who’ve really made it a popular term. I’d say that brands need to look for the right consumers to engage with. Someone who is too influential might be hard to get ahold of or to get them involved and then someone who is not influential is not going to create the peer influence you’re looking for. So what I mean is brands should look for people who will participate and when they participate they will reach other people and those people will react. Basically they should score people on their effectiveness as brand advocates and there are some basic elements that go into this kind of a scoring exercise but are they people who when invited to take part in something participate? Do they participate with high-quality testimonials or product reviews, photos or videos that are appropriate, and when that content is shared does it create action? So if people post a review to Facebook does anybody like it, share it or comment on it?When people post a review on a retailer’s website do other people like that or respond to that review? So instead of just looking for influence it might be the wrong metric. I think you’re looking for influence paired with a willingness to participate or getting involved with a particular brand.