Albertsons is back on the national scene and beginning to assert its power.

Once the industry’s second largest conventional chain, Albertsons is approaching next year’s 75th anniversary as a single entity again, with more than 1,100 stores and sales estimated at $23 billion — and it is poised to get even bigger.

Despite widespread speculation to the contrary, Bob Miller, the chain’s chief executive officer, told SN Albertsons has no plans to divest any of its banners and may, in fact, decide eventually to go public.

“We’re in this for the long haul — to run a great supermarket company,” he said.

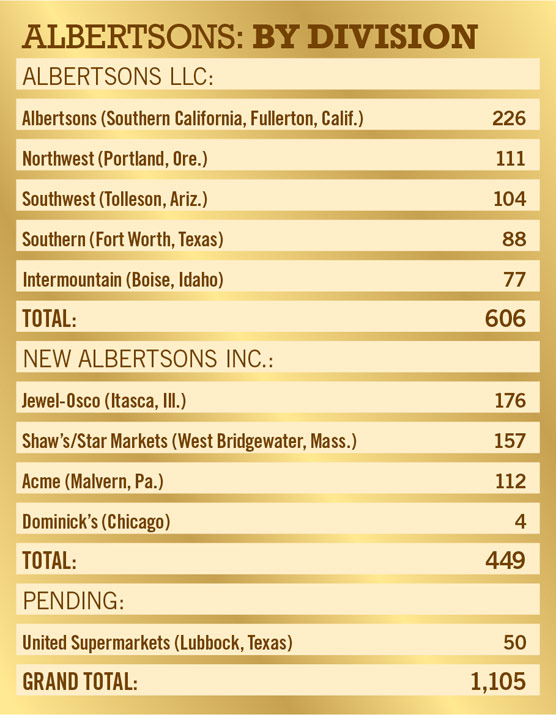

Albertsons’ eight divisions includes five divisions operating as part of Albertsons LLC (Southern California, the Intermountain region, the Northwest, the South and the Southwest), and three divisions operating as part of New Albertsons Inc. (Jewel, Shaw’s and Acme).

The company — which was split in 2006 between private investors and Minneapolis-based Supervalu — was essentially reunited earlier this year when the investment group acquired the rest of the chain’s banners.

“We bought several iconic banners, some of which are close to 100 years old,” Miller said, “and our intention is to run really good stores and make them better. We have no plans to sell any of the brands.

“Are we going to sell or close a few stores? Certainly. But the majority of the 1,100 stores are not on the market, and we don’t plan for them to be.

“We have a really great company, with great opportunities to improve, and we think we can be very successful for many years.

“In fact, we may go public or do something else to keep the company together, though we’re not quite sure yet what that will be.”

All eight of Albertsons’ divisions are profitable, with improving identical-store sales, Miller said, “and we continue to look for ways to be priced better.”

Still, industry observers are not sure how long the investment group that owns Albertsons will wait before starting to divest some of its weaker banners.

“Really, it’s about shareholder value,” said Neil Stern, senior partner at McMillanDoolittle, Chicago. “Albertsons’ first mission is to turn the stores around. How long that will take is the first question. Once that happens, the next question is how to get the best value for the owners, whether that means taking the company public or selling it.

“Really, it’s about shareholder value,” said Neil Stern, senior partner at McMillanDoolittle, Chicago. “Albertsons’ first mission is to turn the stores around. How long that will take is the first question. Once that happens, the next question is how to get the best value for the owners, whether that means taking the company public or selling it.

“What most industry people anticipated was Albertsons would begin to sell off stores or weak divisions right away and focus on the divisions with the highest value. Apparently most industry people were wrong.

“When you look at the history of some of the banners Albertsons owns and the problems with acquired stores in general, it’s all very daunting, so outside observers decide it makes the most sense to sell off some pieces to focus on those with the biggest opportunities.

“But it’s all a matter of execution, and Albertsons executes really well, so the stores it operates — including some of the ones it acquired earlier this year — are doing well.”

One analyst said Cerberus could simply be waiting for a more opportune time to sell. “It’s clear the owners want to flip their investment, but now is not the right time. So they’re investing in the store base to turn things around, and as the economy improves and there’s better access to the capital market, those stores could provide a great opportunity for a buyer.”

Read more: Albertsons Opens on Site of Chain's First Store

Miller sought to dispel that kind of speculation as he talked with SN about Albertsons’ pending acquisition of Lubbock, Texas-based United Supermarkets, a chain of 50 stores — an acquisition that surprised some observers who expected the owners to shrink the chain rather than expand it.

“Would we buy a company like United and pay a good price for it if we were just going to turn around and sell the stores? No,” Miller said.

“It takes a lot of money to make this kind of acquisition, and we wouldn’t make the investment if we were simply going to sell stores.”

'Generating Cash'

Miller, 69, was hired in 2006 by Cerberus Capital Management, the New York-based hedge fund that assembled a consortium of real-estate companies to acquire 661 Albertsons stores, with the intention of selling them for their real-estate value.

It was apparently Miller who convinced the investors not to put everything up for sale.

“Bob Miller is a super operator, and he wouldn’t have taken the job if it was only about disposing of real estate,” Stern said.

Miller offered a similar explanation in a 2009 interview with SN. “When we started, the goal was to close or sell as many properties as we could for their real-estate value.

“But when the investors hired me, I wasn’t interested in shutting all the stores down. I asked if they would let us try to make the stores successful, which would require the right kind of investment on their part, and they said OK.”

Speaking with SN last month, Miller said Albertsons sold or closed approximately 400 of the first group of stores it bought, “and once we started focusing on the stores that were left, the investors got all their money back with some profit,” Miller said, “and they changed their minds [about selling the rest] because of the good results we were getting — the stores were generating cash,” he said.

Speaking with SN last month, Miller said Albertsons sold or closed approximately 400 of the first group of stores it bought, “and once we started focusing on the stores that were left, the investors got all their money back with some profit,” Miller said, “and they changed their minds [about selling the rest] because of the good results we were getting — the stores were generating cash,” he said.

According to Miller, Albertsons cleaned up the acquired stores with minor paint-and-patch jobs; upgraded fresh departments by buying for quality, not price, while keeping grocery prices in check; and added store labor.

Albertsons also introduced bonus incentive programs for store directors and department managers to help boost cash flow, he said.

“Now the investors like the supermarket business because they’ve learned that if you run good grocery stores, you can generate a lot of cash,” Miller pointed out.

Cerberus likes the business so much, it may be pursuing all or part of Safeway as its next acquisition, industry sources pointed out. Miller declined to comment on the speculation.

Cerberus bought the remaining 887 Albertsons stores from Supervalu late last year — including Shaw’s in New England, Acme in Philadelphia, Jewel-Osco in Chicago and Albertsons in Southern California.

Cerberus bought the remaining 887 Albertsons stores from Supervalu late last year — including Shaw’s in New England, Acme in Philadelphia, Jewel-Osco in Chicago and Albertsons in Southern California.

It boosted its store count further in September when it announced it would acquire the United stores — a transaction that will push the Albertsons store count past 1,100, Miller said.

In October Albertsons acquired four Dominick’s stores in Chicago after Safeway announced it would exit that market. “They are four good, high-volume stores, so we bought them quickly to fill in areas where we lacked stores,” Miller said.

Albertsons will continue to operate those stores under the Dominick’s banner until January, when they will all be converted in the same week to the Jewel-Osco brand, he said.

Asked whether Albertsons might acquire additional Dominick’s locations, Miller said, “We would consider acquiring stores anywhere if we think they would help make us a better and stronger company.”

Miller said he expects Albertsons to seek out additional acquisitions around the country. “We’re still looking at companies that fit into our store network, the way United does,” he noted.

“United is a company that offers a lot of ideas we can share to make our other stores better. For example, it has a great Hispanic brand, Amigos, and a great upscale brand, Market Street, and we see opportunities to expand both concepts to other parts of the country.

“United is a company that offers a lot of ideas we can share to make our other stores better. For example, it has a great Hispanic brand, Amigos, and a great upscale brand, Market Street, and we see opportunities to expand both concepts to other parts of the country.

“If we decided to operate a Hispanic format in Southern California, for example, we could use the Amigos name, and we might try that.

“And with Amigos in Texas and possibly California, it would help give us a better understanding about products that will appeal to Hispanics in other markets.

“With Market Street, we can take what we learn in Texas to other stores — for example, in affluent areas of Chicago where we operate Jewel-Osco.”

'Having a Lot of Fun'

Miller told SN he contemplates retiring at some point, though he said he has no timetable. “I’m having a lot of fun bringing the different brands back to life and making them into stronger companies,” he said.

Miller said he has talked with the company’s investors about a succession plan, “and we have two or three top-notch candidates we’re working with, and with eight division presidents, we have a lot of talent available to us.”

Miller started his industry career in 1961 at the original Albertsons, spending 30 years there and rising to become executive vice president, retail operations. He left in 1991 to become chairman and CEO of Fred Meyer Inc., then moved with other Fred Meyer executives in 1999 to Rite Aid, where he served as chairman and CEO till 2004, when he became chairman of Wild Oats Markets.

Asked what it felt like to come back to Albertsons, Miller told SN it was “a comfortable transition because I knew so many people here.”

He said he was also familiar with a lot of the stores “because as executive vice president of retail operations [at the original Albertsons chain], I approved all store sites, many of which were still in the mix, and there were still a lot of good stores I’d been involved with before I left and a lot of people at store level that were still around.”

He said he was also familiar with a lot of the stores “because as executive vice president of retail operations [at the original Albertsons chain], I approved all store sites, many of which were still in the mix, and there were still a lot of good stores I’d been involved with before I left and a lot of people at store level that were still around.”

Dick King, executive vice president and managing partner at Encore Associates, San Ramon, Calif., and the former president and chief operating officer of the original Albertsons, said he believes the return of so many veterans is significant.

“It brings continuity to the organization, with people who know the Albertsons systems because they were involved with the chain for so many years, and that continuity will foster better execution,” he told SN.

Albertsons, which was once one of the nation’s top two chains based on volume, saw its fortunes begin to fluctuate in 1999, following its acquisition of American Stores Co.

SN Blog: Albertsons Move Sparks Great Loyalty Debate

Problems integrating the two operations ultimately led to the breakup of the chain in 2006, when Minneapolis-based Supervalu acquired the so-called premium divisions of Albertsons and the Cerberus-led investment group bought the so-called underperforming stores.

At that time the 661 stores Cerberus bought were operating with comparable store sales of negative-5%, Miller told SN, “and they had not had any capital spent on them for three or four years, so store conditions were terrible.”

By late 2012 Albertsons had sold or closed two-thirds of the stores, leaving it with 192 locations.

But when Supervalu decided late last year to divest the rest of the Albertsons banner, “we bought them [for $3.3 billion] because they were iconic brands we thought could be successful,” Miller said.

Sidebar: Albertsons Reunites Veteran Executives

The Albertsons family of stores is back together again — and so is the Albertsons family of executives and employees.

For P. Shane Sampson, a 25-year veteran who left the company for three years, returning to Albertsons in March to head the 157-store Shaw’s/Star division felt a lot like coming home again, he told SN.

He came back, he explained, “because I love a challenge, and because it was an opportunity to come back to my industry family.

“We’ve all worked together so we’re like a second family to each other, and we all understand the culture of this company and love it.”

According to Sampson, the Albertsons culture involves “giving customers the products they want at a price they’re willing to pay, along with lots of tender, loving care. That was Joe Albertson’s philosophy, and it’s the philosophy Bob Miller brought us up on — taking care of customers first and also looking out for team members and associates.

“Joe Albertson had a passion for customers and for people, and that continues to live on today through Bob Miller’s vision.

“It’s about products, value and great customer service. We’re a very hands-on organization that spends a lot of time in the field, interfacing with customers and associates and, being decentralized, making decisions quickly.”

According to Susan Morris, president of the company’s Intermountain division, “What we like to say is, ‘We’re getting the band back together again.’”

Morris is a 28-year Albertsons veteran who has headed the Intermountain division, encompassing 97 stores in eight states, since March.

When her division was sold to Minneapolis-based Supervalu in 2006, Morris stayed with the stores as senior vice president, marketing and merchandising. While she did the job her employers asked her to do, she was not very happy about it, she told SN.

Readed more: Reunited Veterans Seen Returning Company to Its Roots

“Supervalu was working hard to centralize marketing and merchandising and doing what it had to do to satisfy shareholders, with a focus on spreadsheets and the newest technology rather than selling, service, quality and price,” Morris said.

“But the bread-and-butter at the legacy company was always to focus primarily on the customer, not shareholders. The priority was always driving sales, not driving the bottom line.”

When Morris had the chance to return to Albertsons in 2009, she took a lesser title [grocery sales manager] in the Southwest division “just to be involved with an organization focused on what was important to me — driving sales and empowering people in the divisions to take responsibility and try different things,” she noted.

Morris said she was elated when she attended her first meeting with Bob Miller, “and he told us the No. 1 priority was sales, and the No. 2 priority was sales and we would make money doing that, which was a complete shift from what the focus had been at Supervalu,” she said.

Looking back, Morris said she was a bit skeptical that the new owners could restore the luster to the Albertsons stores formerly operated by Supervalu.

But by following the philosophy that had made the original Albertsons successful, the business has turned around, Morris said — with sales in her division up 3% and same-store sales up over the year-ago numbers.

“Supervalu had installed a lot of cost controls, which meant store upkeep fell, but we incented managers to show customers a spanking clean store, and we added 3,000 employees and boosted labor hours by expanding hours of operation, particularly in the service departments, where we began opening earlier and closing later.

“As a result, we’ve reduced turnover and improved employee morale. For a while, employees said they were embarrassed to tell friends they worked for Albertsons, but that’s no longer the case.”

Morris’ division also lowered prices on 1,600 key items, she said. “We’re not the lowest-priced, but we’re more reasonably priced on the most important items. Besides lowering prices across the stores, we also dramatically improved the quality as well as the pricing on produce.”

With divisions empowered to make their own decisions, Morris said the Intermountain division is introducing a new meat program. “We had already switched over to 100% Choice beef, but in our division, we’ve begun using a new supplier who’s known throughout Idaho for its RR Ranch label.

“Our plan is to co-brand using that label throughout the state, and though we’ll keep our own Steakhouse Choice label in the other states in the division, the product will come from the same supplier.”

The new supplier began distributing product to the chain during the fall, Morris said, though the program will be in transition till a major launch in January, she added.

Asked how customers are reacting to all the changes taking place at the stores she oversees, Morris said, “They love it. Traffic was down dramatically before LLC took over the stores, though this was one of the better divisions.

“But Idaho is home for Albertsons, and while a lot of customers said they wanted to shop with us, they were not being given enough reasons to do so. Now, rather than complaining, they are telling us how happy they are to be able to shop again at Albertsons.”

Sidebar: Albertsons Maintains Decentralized Model

The new Albertsons has a clear vision of how to operate conventional stores, Bob Miller, chief executive officer of the 1,100-store chain, told SN.

“We want to run really good supermarkets and take care of customers and associates — simply getting back to the basics of taking care of customers by giving them what they want at a reasonable price, which is Joe Albertson’s old philosophy,” he explained.

The goal is “to develop a business where people think it’s fun to shop, built around a culture of taking care of customers,” he said.

“We just need to run better stores so people feel good about their Acme or Jewel or Shaw’s or Albertsons.”

“We just need to run better stores so people feel good about their Acme or Jewel or Shaw’s or Albertsons.”

Miller said he continues to believe in the conventional-store format, despite the influx and success of discount and specialty formats. “Conventional stores work, and I don’t see the need to do anything differently,” he explained.

“As long as you have good locations, clean, well-run stores, high-quality perishables, great service and great pride — in a company with a good balance sheet — then conventional stores can survive and prosper.”

Albertsons operates with a decentralized approach, just like the original chain did, Miller pointed out.

“Being so decentralized makes us different than most of our competitors, but we know this approach works from operating our original group of stores [before the acquisition of the balance of the Albertsons banners earlier this year],” he said.

“It’s a great model, with a single go-to-market strategy whose goal is to make money selling goods, not buying them, and we make sure vendors know the allowances they give us will be used to sell more merchandise.

“Some companies are more interested in putting allowance money into the bank than into merchandising. Our aim is to put money in the bank by selling products.

“The result for us of doing that has been that case movement is up and identical sales are up in all divisions.”

Each division has a president, “whose most important job is to run his division — to make sure we are successful by overseeing personnel, pricing, merchandising and customer relations,” Miller explained.

Back-office functions like accounting and payroll are centralized, along with nonfoods, and the company runs three or four major companywide promotions a year, he added.

“I always say the grocery business is simple — it just has a lot of complex parts,” Miller told SN. “I believe that, if you offer quality perishables, clean stores, reasonable prices and good service, then you’ll be successful. And while each of those is simple to do, each requires a lot of work.

“We have eight division presidents who grew up at [the original] Albertsons, and they understand clearly what we want.”

| Suggested Categories | More from Supermarketnews |

|

|

|

|