For a clue to the future of online grocery shopping, take a look back at the history of Piggly Wiggly, the iconic supermarket banner.

In 1916, Clarence Saunders, founder of the original Piggly Wiggly stores, opened the inaugural self-service grocery store in Memphis, Tenn. For the first time, customers, rather than store employees, picked their own items and brought them to a cashier. This became — and remains in 2012 — the de facto format for all supermarkets.

But in 1937, Saunders invented a different way for consumers to purchase groceries, what he called “Keedoozle,” which reprised the product-selection role for employees. Also located in Memphis, the first Keedoozle store provided a “key” to shoppers, who used it to select sample products on display behind rows of glass cabinets. The selections were recorded on a ticker tape, which the shopper took to a cashier for processing. An electronic reading mechanism deciphered the tape, calculating the cost and sending instructions to a hidden stock room, where employees assembled orders and sent them on conveyor belts to the checkout area for pick-up.

Well ahead of its time, the Keedoozle format was tried in 1937, 1939 and finally in 1948 before Saunders gave up on it. Saunders’ initial idea for self-service obviously fared a lot better, yet the Keedoozle concept — empowering consumers to select products by means of technology, and having those products selected by employees and brought to a pick-up location — has made a comeback at Piggly Wiggly and may be the method by which online grocery shopping makes significant inroads in the global food retailing industry.

In 2008, 60 years after the demise of Keedoozle, privately held Piggly Wiggly Carolina, Charleston, S.C. — one of the offshoots of the original Piggly Wiggly Corp. — introduced “Click’nShop” to seven stores, and last year expanded the program to 36 stores, mostly in metropolitan areas with busier shoppers. (Piggly Wiggly Carolina operates 66 corporate stores and supports about 34 independent outlets; all of the Click’nShop stores but one are corporately owned.)

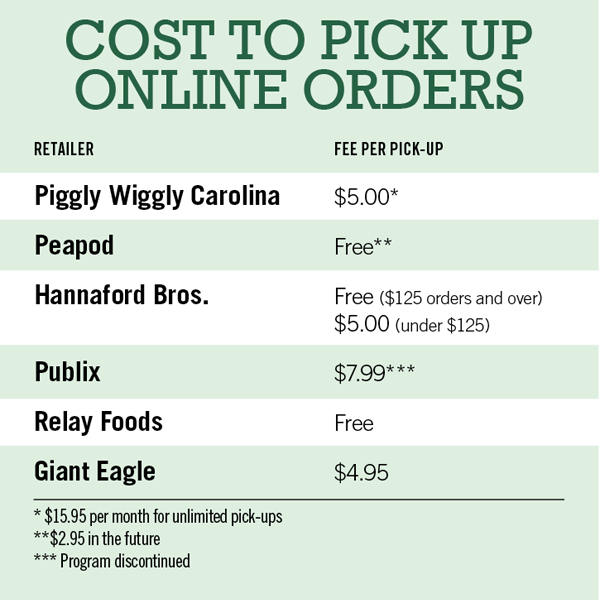

Instead of selecting items with a key at an in-store display, Click’nShop customers use a mouse at a home computer to choose any of the store’s items at thepig.net. For a $5 fee, the orders are selected at a nearby store and made available for pick-up four hours after the order was placed. (Three of the 36 Click’nShop stores also offer home delivery of online orders.)

“If you make more than $5 an hour, it doesn’t pay to shop for your own groceries,” said Bethany T. Harmon, operations manager for Click’nShop. “We only charge $5 and we save people a lot of time.” Shoppers using the program range from mothers with small kids, vacationers and young adults strapped for time. Piggly Wiggly Carolina does not currently plan to expand the program to more stores, but is open to the idea, she added.

Online grocery shopping began, and has largely evolved, as a home-delivery operation. But store pick-up of online orders has always had adherents and is now increasingly being regarded as a viable alternative to home delivery that offers consumers greater flexibility — they don’t have to wait at home for a delivery during a designated period — while cutting operational costs for retailers. “Nobody wants to wait for the cable guy, and nobody wants to wait for their groceries,” said Harmon.

Grocery e-commerce in the U.S. remains a minor part of overall volume — about 2% in 2011, according to Nielsen. Nielsen projects that e-commerce for CPG goods will grow at a 25% rate through 2015, raising its share of overall volume to 5%. Another market research firm, IBISWorld, Santa Monica, Calif., last month projected online grocery shopping to grow at an annual rate of 9.5% and reach $9.4 billion in 2017.

Alec Newcomb, chief strategy officer, MyWebGrocer, Winooski, Vt., a 12-year-old firm that supports the e-commerce operations of 70 retailers, including Piggly Wiggly Carolina, ShopRite and Harris Teeter, believes the store pick-up model will expand grocery e-commerce’s footprint. MyWebGrocer’s clients already have about two-thirds of their online volume being processed through pick-up, and one-third through home delivery. Newcomb says the overall U.S. market will evolve to the volume percentages experienced by his company’s retailers.

“Pick-up will become the dominant platform in the U.S., with delivery in urban areas where it makes economic sense,” he said. “The reason is that pick-up is just a lot more profitable than home delivery,” especially given rising gas prices. “We always encourage customers to start out with pick-up and then add delivery once they have enough volume to keep a truck busy.”

According to consumer polls run by MyWebGrocer, consumers prefer pick-up because “they feel they have more control,” both with scheduling and product inspection, said Newcomb. At the store, “they can peer into the bag and if they have the wrong milk they can swap it out.”

Another form of pick-up is for a retailer to deliver multiple orders to a centrally located third-party location like a senior center or a school where pick-ups can take place. “The fastest-growing part of the business is the hub-and-spoke model,” Newcomb said.

SN Poll results: Best Online Grocery Shopping Model

Mark Heckman, a former marketing executive at Marsh and now head of his own consulting group in Bradenton, Fla., noted that pick-up could be a “natural first step” in online grocery shopping. “It’s incremental, not as dramatic a change as home delivery.”

One impediment to store pick-up is that many stores are not set up to smoothly accommodate drive-through pick-up arrangements, noted Paul Weitzel, managing partner at consulting firm Willard Bishop, Barrington, Ill. “In the future, stores will be designed with drive-up and dedicated slots so you don’t have to get out of your car.”

Moreover, online grocery shopping — whether pick-up or home delivery — still needs to overcome the traditional in-store shopping patterns that are baked into most people, noted Brian Cohen, executive vice president and general manager, Etailing Solutions, Westport, Conn. It may require adoption by a younger generation whose expectations are not, ‘I shop at the supermarket once a week, that’s what I do,” he said.

Europeans Embrace Pick-Up

Europe has been a hotbed of in-store pick-up activity. In France, about 1,700 stores, at chains like Casino Group and Groupe Auchan, offer pick-up options, noted Alan Davies, chief marketing officer, Aldata, Helsinki, adding that some shoppers make daily pick-ups on the way home from work. In the U.K., Tesco, which has a robust home-delivery service, plans to offer drive-through pick-up in 150 stores by the end of 2012, according to Bloomberg Businessweek. And late last month Ahold announced that Albert Heijn, its Dutch supermarket chain, opened its first store pick-up point for online orders.

In the U.S., two of the industry’s biggest players — Amazon and Wal-Mart Stores — are beginning to explore pick-up models, as well as same-day delivery. Amazon has limited its AmazonFresh grocery program so far to Seattle, but the company has been testing drop-off/pick-up lockers at 7-Eleven outlets in some markets, and last week Reuters reported that Staples has agreed to install Amazon pick-up lockers in its U.S. stores. Amazon is testing same-day shipping in a number of markets — a sign that it is “getting into grocery and more time-sensitive items,” said Newcomb.

Meanwhile Wal-Mart, which is running an online grocery shopping test in San Jose, Calif., would be well positioned to try pick-up of groceries at its ubiquitous stores. “Retailers are worried about smaller format Wal-Mart stores [being used for] pick-up,” said Newcomb.

Peapod, Skokie, Ill., the 23-year-old granddaddy of online grocery shopping, serves about 400,000 customers in 24 markets in the Chicago area and on the East Coast, where it is aligned with Stop & Shop and Giant stores owned by its parent, Ahold USA. Peapod is also exploring pick-up options to alleviate shopper concerns about its two-hour home-delivery window.

Peapod recently began experimenting with store pick-up at a location in Palatine, Ill., as well as at Stop & Shop stores in Abington, Mass., and Lincoln, R.I. “I hear this all the time — ‘What if I can’t be home for two hours,’” said Elana Margolis, spokeswoman for Peapod. “So [with pick-up] we’ll see some new customers fearful about home delivery.” Some train commuters who park at the station may pick up their orders on the way home, she noted.

The Palatine location, opened last month, is an old Blockbuster store where Peapod delivers temperature-controlled totes containing online orders from its warehouse in Chicago. Shoppers drive up to the store and employees bring out their orders. Orders made before 10 a.m. can be picked up after 4 p.m. the same day. Peapod hopes to add two more similar pick-up locations in the Chicago area by the end of the year.

In August, Peapod began allowing shoppers at a Stop & Shop in Abington to have their online orders brought out to their car in a former drive-through pharmacy area. Shoppers pick one-hour pick-up slots, but same-day pick-up is not offered. Margolis noted that future pick-up sites may be at a parking lot near, but not adjacent to, a store.

Peapod offers the pick-up service for free but will eventually include a $2.95 charge. By contrast, the online retailer charges $6.95 for home delivery of orders above $100, and $9.95 for orders between $60 — the minimum required for home delivery — and $100.

Pick-up orders require no minimum expenditure; this and the lower service fee for pick-up mean that while the typical Peapod shopper is more affluent than average, that may not be the case for pick-up shoppers, noted Margolis. Peapod’s average order totals $160 and comprises 55 items.

Heckman observed that pick-up at a now-discontinued program at Marsh attracted “totally different” customers. “They were busy moms and dads who didn’t have time to shop at the store,” he said. “Home-delivery customers were more elderly, less ambulatory.”

A number of regional chains are also beginning to dabble in pick-up for online shoppers. Giant Eagle launched its “Curbside Express” service at its Robinson Market District store in Pittsburgh last April, charging a $4.95 pick-up fee. To date the store has processed more than 5,000 online orders. “We have received a great response from customers who appreciate the convenience of saving time by shopping online,” said Daniel Donovan, a Giant Eagle spokesman. The chain is evaluating opportunities to expand the service in the near future.

Hannaford Bros., Scarborough, Maine, began offering drive-through pick-up of online orders at a store in Dover, N.H., in March 2011, followed by a similar offering at a store in Windham, Maine, in November 2011. The service is free for orders of $125 or more; below $125 there is a $5 fee. Same-day pick-up is available as long as customers order before 3 p.m.

“Both stores have done well and met our expectations,” said Michael Norton, a Hannaford spokesman, adding that the average order size is about four times larger than a typical order purchased in-store. The chain has no plans currently to bring the pick-up service to other stores.

The Windham store, located in a lakeside area, has attracted vacationers who order online and pick up their groceries en route to their vacation lodging, “saving time to be on the lake instead of shopping,” noted Norton.

Not all pick-up scenarios have panned out. Publix Super Markets, Lakeland, Fla., tested a curbside pick-up service at three locations, one in Tampa and two in the Atlanta market, beginning in August 2010. The service, which charged a $7.99 pick-up fee, ran for one year before it was discontinued. “Our customers enjoy the interaction with our friendly and knowledgeable associates,” said Maria Brous, a Publix spokeswoman. “Publix is a gathering place, and our customers enjoy the overall shopping experience.” Publix also tested an online shopping service using home delivery, called PublixDirect, between 2001 and 2003.

But Publix has not given up entirely on online shopping and store pick-up. In August, the chain began a pilot of online ordering for deli purchases, which was expanded last month to 50 Publix locations. Customers can place their deli orders online or via a mobile device at www.publix.com/order and specify a pick-up time. Orders are staged at a designated location in the deli department and identified with “Online Easy Pickup” signage.

Personal Shopper's Role

Most store pick-up scenarios depend on reliable employees who prepare the orders. At each of its Click’nShop stores, Piggly Wiggly has a “primary personal shopper,” an employee with other responsibilities who is trained to pick online orders, and is supported by other employees who understand the program. At a few high-volume stores, the personal shopper’s main job is picking orders.

After receiving an order, the Piggly Wiggly personal shopper will place a “welcome call” to the customer to ask for clarification of selections, such as how thick a rib-eye steak should be cut or how ripe the bananas should be, if those directions are not indicated in the online order. The personal shopper might even suggest an alternative produce item if the one selected is not at peak condition. In addition, if an item is out of stock, personal shoppers will try to find it at other area stores or let the customer know it’s not available.

“Placing an order online is an act of faith,” said Harmon. “So I like to make sure the customer knows it’s a real person shopping their order who knows that apples are best if not bruised and cares about how they like their sandwich meat sliced.”

If a shopper is not satisfied with an item once they get home, the item will be free on their next trip and their order fee will be waived. “We put pressure on the personal shopper to get it right,” Harmon said.

Orders are temporarily stored in four temperature-based storage locations at Piggly Wiggly stores: frozen, cold, warm and dry. Orders are reassembled when the customer arrives to pick it up. Each store has a designated parking spot where the customer calls the store, prompting an employee to bring out the order and collect payment (with a wireless credit card machine if needed). Customers also have the option of coming into the store to pick up their order and paying at the service desk. “Some shoppers enjoy coming in, seeing what’s new, picking up a few additional things or getting lottery tickets,” said Harmon.

Piggly Wiggly Carolina allows shoppers to pick up their orders between 10 a.m. and 7 p.m. in half-hour time slots; if they place their order by 2:30 p.m., they can pick it up the same day, though the stores are flexible with this deadline. Indeed, Piggly Wiggly Carolina allows a fair amount of leeway with any pick-up time. “They may sign up for a time slot, but we don’t hold them to that,” said Harmon, noting that most people come close. “We let the pick-up time be a guide to the staff, not a hindrance to the customer.” Shoppers are encouraged to let the store know if they are going to be more than an hour late; if they don’t, the store will call and reschedule for the next day. “It’s very personalized — that’s why it’s successful,” she said.

In addition to offering a more flexible order-acquisition schedule for consumers, Piggly Wiggly Carolina chose to emphasize a pick-up model rather than home delivery to reduce cost factors such as insurance and mileage, said Harmon.

Piggly Wiggly Carolina tried home delivery at its original pick-up locations but shoppers did not take sufficient advantage of it. “I don’t know if it was those particular areas or because of the price of delivery,” said Harmon. Of the three stores still offering home delivery, two use an outside delivery vendor (which charges a $25 to $35 delivery fee) while one handles it internally (with a flat $10 delivery fee). Although Click’nShop is a corporate program, the decision to offer home delivery is left up to individual stores.

About a third of customers pay a flat monthly rate of $15.95 for unlimited pick-ups (there is no minimum order quantity), rather than the $5 individual pick-up fee. After introducing the monthly rate, Harmon noticed that basket size diminished, but that is balanced by higher trip frequency. In addition, Piggly Wiggly makes shoppers aware that online shoppers can take advantage of the same deal, coupon and loyalty point opportunities as in-store shoppers.

About a third of customers pay a flat monthly rate of $15.95 for unlimited pick-ups (there is no minimum order quantity), rather than the $5 individual pick-up fee. After introducing the monthly rate, Harmon noticed that basket size diminished, but that is balanced by higher trip frequency. In addition, Piggly Wiggly makes shoppers aware that online shoppers can take advantage of the same deal, coupon and loyalty point opportunities as in-store shoppers.

Piggly Wiggly Carolina requires online shoppers to identify themselves with a loyalty card, which enables the company to track online orders, identify new shoppers, and compare online ordering behavior to brick-and-mortar shopping. The company has found that 85% of online activity is generated by either new customers or existing customers who are spending more online than they did off-line during the previous three months. On average, an online order is four times larger than an in-store order. “Regular customers end up being more loyal customers, doing more of their grocery shopping with us,” said Harmon. “We believe they are no longer splitting up their purchases between us and other stores.”

Online customers are spending more at Piggly Wiggly stores because when they order at home, “they’re in a more relaxed environment, and can organize all of their purchases at one time,” Harmon said. The distractions and pressures of the store can make that more difficult, she believes. Home shoppers may also be less inclined to spend time traveling to a different retailer for a particular sale, she added.

Harmon declined to give the number of shoppers ordering online, nor the profitability of the program, although each Click’nShop store makes a calculation of the number and size or online orders needed for the program to cover costs and break even. Last year, David Schools, president and chief executive officer of Piggly Wiggly Carolina, described the program as having “a loyal fan base.”

Making sure that the store is sufficiently staffed to properly pick online orders is the Click’nShop’s program’s biggest challenge. “It’s hard to schedule [personal shoppers], especially at the beginning” when orders vary, said Harmon. Another pain point was making sure store inventory matches what appears online. “The online store is only as reliable as the information provided by each store,” she added. “We really had to tighten up our files and purge them of old UPCs.”

Sidebar: Mobile's Effect on Online Grocery Shopping

Besides in-store pick-up of orders, mobile apps represent another innovation that may help boost the prospects of online grocery shopping. Online Grocer Peapod, a division of Ahold USA, certainly thinks so.

Peapod’s mobile app, introduced two years ago, is used by 25% of Peapod shoppers in some capacity, often to supplement an order started online, said Elana Margolis, a Peapod spokeswoman. Moreover, Peapod’s mobile app users spend $8 more per order and order more frequently than non-mobile users. “Mobile is a great way to expand the business,” she said.

Peapod has been trying to stoke interest in its mobile app and attract new customers with train-station billboards featuring a handful of bar-coded CPG products. Shoppers can scan a QR code on the billboard to download the app to their phone, and scan product bar codes to populate their shopping list. After leaving the billboard, they can add to their list on the train, or at work or home on their computer, and submit their completed order.

Peapod has been trying to stoke interest in its mobile app and attract new customers with train-station billboards featuring a handful of bar-coded CPG products. Shoppers can scan a QR code on the billboard to download the app to their phone, and scan product bar codes to populate their shopping list. After leaving the billboard, they can add to their list on the train, or at work or home on their computer, and submit their completed order.

After an initial three-month test of the billboards at 17 locations in Chicago and Philadelphia from February through early May, last month Peapod kicked off a second three-month trial in those markets as well as Boston, Washington, and markets in New Jersey, Connecticut and Long Island.

SN Poll results: Best Online Grocery Shopping Model

More than 100 billboards are now out in the field, mostly containing products from five CPG companies (Kimberly-Clark, Barilla, Reckitt Benckiser, Procter & Gamble and Coca-Cola). In Chicago, the billboards feature only products from local restaurants and homegrown brands, such as Wildfire, Big Bowl, Intelligentsia Coffee and Eli’s Cheesecake. According to Margolis, the products featured on the billboard in the first test experienced a roughly 20% average increase in sales.

Paul Weitzel, managing partner at consulting firm Willard Bishop, Barrington, Ill., pointed out that mobile tablets like the iPad are facilitating online grocery shopping. “One retailer told us that his online business increased significantly when the iPad took off,” he said. “It lets you sit in front of the TV and do the order, which is harder to do on the phone. And you don’t have to fire up your computer to do it.”

Sidebar: Online Farmers' Market

CHARLOTTESVILLE, Va. — Relay Foods, an online-only food retailer here, which offers a mix of conventional groceries and local/organic fare, has developed a fulfillment model that combines pick-up and home delivery.

Relay began serving the Charlottesville and Richmond, Va., markets in 2010, and this year, through a merger in July with Washington-based Arganica Farm Club, an online farmers’ market, has begun serving the Washington, Baltimore and Philadelphia markets.

Relay partners with 130 local farms and producers, mostly in Virginia and Maryland. The company also sources goods from Whole Foods stores as well as other local food retailers. “We offer both conventional and local foods to give people the opportunity to move toward local foods in a stepwise fashion,” said Caesar Layton, Relay’s senior vice president of marketing and sales.

In Charlottesville and Richmond, where Relay has a distribution center in each market, 85% of the volume is distributed at 25 to 30 pick-up locations such as schools, churches and commuter routes, while 15% is home delivered, said Layton. By contrast, in Washington, where 12 pick-up locations were just established last month, home delivery accounts for 95% of orders and pick-up 5%.

Baltimore and Philadelphia are both home-delivery markets, though pick-up locations are planned for November and December, respectively. Relay is opening a new fulfillment center in early 2013 that will service Washington, Baltimore and Philadelphia.

Relay distributes orders at pick-up location parking lots from its own trucks, which have awnings. Orders are carried to customers’ cars. “Because we’re an online company, our associates are trained in how to engage customers,” said Layton. Customers can pick up orders the day after placing them online in Charlottesville and Richmond.

Pick-up is a free service, while home-delivery charges range from $20 to $37 per month, or $10 to $12 per delivery.

| Suggested Categories | More from Supermarketnews |

|

|

|

|