Supermarket customer satisfaction rebounds amid pandemicSupermarket customer satisfaction rebounds amid pandemic

Grocery customers find improved in-store conditions, Retail Feedback Group study says

December 18, 2020

Customer satisfaction with supermarkets is up as both shoppers and retailers have adapted to conditions under the nine-month-old coronavirus crisis, new research from The Retail Feedback Group (RFG) shows.

In RFG’s Fall 2020 U.S. Online & In-Store Grocery Shopping Study, released yesterday, shoppers rated overall satisfaction of their latest supermarket trip at 4.23 on a scale of 1 to 5, up from 4.08 in the Lake Success, N.Y.-based research firm’s spring study. Similarly, customers gave supermarkets a Net Promoter score of 39.5 in “likelihood to recommend” in October, up from 36.1 in April, RFG said.

Both of the fall and spring RFG studies, conducted in October and April 2020, respectively, are based on a nationally representative sample of 2,000 U.S. who shopped for food and groceries in the past 30 days. The sample was evenly split between in-store and online shoppers.

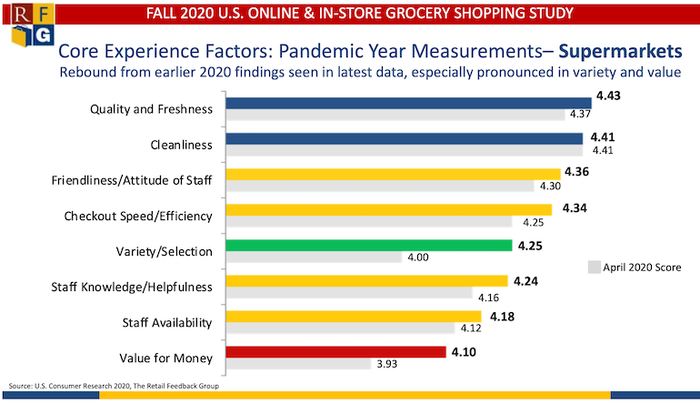

Among in-store shoppers, the upswing in grocery customer satisfaction was led by higher favorability in variety/selection, which scored 4.25 on a five-point scale in October versus 4.00 in April. That was followed by value for the money (to 4.10 in October from 3.93 in April), checkout speed/efficiency (to 4.34 from 4.25), staff knowledge/helpfulness (to 4.24 from 4.16), quality and freshness (to 4.43 from 4.37), friendliness/attitude of staff (to 4.36 from 4.30), staff availability (to 4.18 from 4.12) and cleanliness (stayed the same at 4.41).

“While we saw a rebound for overall satisfaction, and across nearly all core experience factors, supermarkets need to weigh differentiators and how to leverage them in the current environment,” RFG principal Doug Madenberg said in a statement. “In particular, a focus on providing good value for money spent remains a must, based on economic conditions. Further, although a challenging time, employee friendliness could never be more important, given the high impact it has on the likelihood of shoppers to recommend the store to others.”

A larger share of shoppers (39%) in the fall study reported they are shopping for food and groceries at about the same frequency as pre-pandemic, compared with 20% in the spring study. Thirty-four percent said they shop less often, down from 55% in April, while 27% shop more often, up slightly from 25% in April.

Nearly half (45%) of the shoppers in the fall survey said they spend more on food and groceries now versus before the pandemic, down from 51% in the spring research. A higher percentage spend about the same now (38% versus 30% in April) and about the same percentage spend less (18% versus 19% in April).

Of those polled, 77% aim to continue shopping the same frequency at supermarkets in the next year, RFG said. Just under a third (32%) said they feel highly confident about safety in supermarkets amid the pandemic, about the same percentage as in the spring study (33%).

With the recent resurgence in COVID-19 cases nationwide, grocery customers are continuing to stockpile goods from categories throughout the store, including fresh and shelf-stable items, RFG noted. For example, 59% of shoppers now keep canned and boxed items on hand for a few months or more, compared with 43% pre-pandemic. Likewise, 45% of shoppers keep frozen foods on hand for a few months versus 34% pre-pandemic.

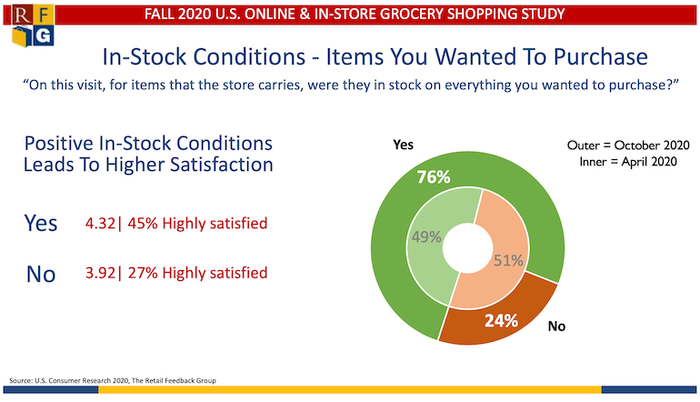

But unlike the panic-buying triggered by the pandemic in the spring, shoppers exhibit higher satisfaction with in-stock conditions both in stores and online. The October study found 76% of supermarket customers reporting the store had everything in stock they wanted to purchase, up from 49% in April. Online, that percentage rose to 68% from 51% in April.

Overall satisfaction among online grocery customers also has rebounded, up to a score of 4.44 on a five-point scale from 4.38 in the spring study. RFG revealed that online grocery shopper satisfaction rises with frequency of use, from 4.19 for first-time users, to 4.26 for two to five times, to 4.59 for six to 19 times, and to 4.72 for 20 or more times.

Among online grocery providers, the largest gains in shopper satisfaction came from Amazon (to 4.63 in October from 4.47 in April) and Instacart (to 4.46 from 4.35). Walmart (to 4.41 from 4.38) and supermarkets (to 4.37 from 4.33) saw smaller gains in online customer satisfaction.

“As online shopping stabilized over the last several months, overall and channel satisfaction improved,” according to RFG principal Brian Numainville. “Walmart benefitted most from the surge in online shopping, showing continued growth, while supermarket shoppers slipped downward with the lowest percentage of shoppers, compared to Walmart and Amazon, indicating they plan to purchase groceries online in the coming year.”

Indeed, the fall RFG study showed the highest percentage of shoppers most recently using Walmart for online grocery shopping (47%), up from 40% earlier this year. Supermarkets fell to 25% after having increased to 34% in April from 22% at the end of 2019, while Amazon grew slightly to 18% from 14%. Instacart has continued to surge, with 43% of shoppers saying they recently used the service, up from 36% in April and 27% at the close of last year.

When asked about buying grocery items online in the coming year, supermarket shoppers exhibited the lowest intent ,with 32% saying they will do so more (downfrom 44% earlier this year), compared to 48% of Walmart shoppers and 54% of Amazon shoppers.

Added Numainville, “With many shoppers continuing to shop online and in-store, supermarket retailers should continue to invest in both to remain relevant and attract new customers.”

For our most up-to-date coverage, visit the coronavirus homepage.

About the Author

You May Also Like

.webp?width=300&auto=webp&quality=80&disable=upscale)