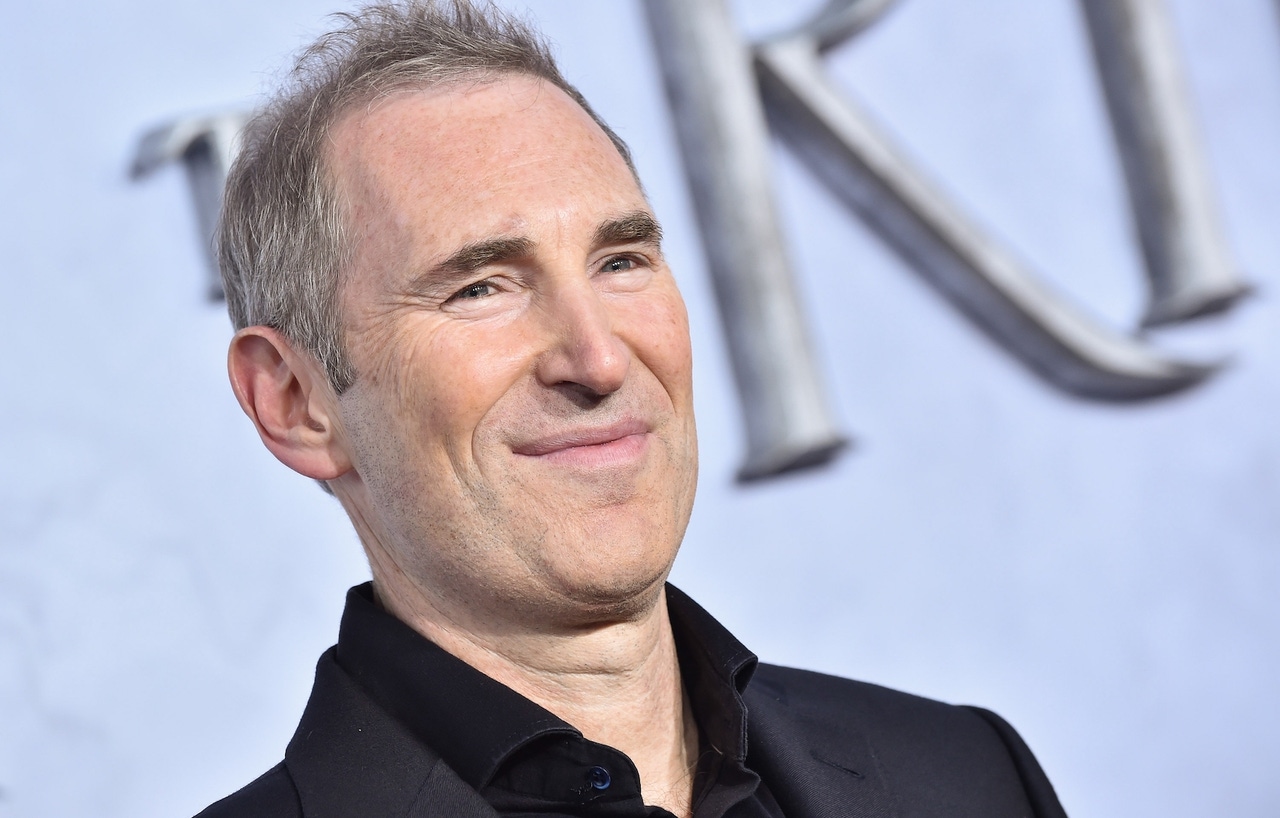

Amazon CEO Jassy: Grocery a ‘big opportunity’Amazon CEO Jassy: Grocery a ‘big opportunity’

The retail giant aims to broaden the scope of its grocery offering, which will require an expanded physical store footprint, according to its second annual letter to shareholders.

The grocery market has had its ups and downs for Amazon over the last year, but the retail giant on Thursday said in its second annual letter to shareholders that the $800 billion market still holds huge potential for the company.

Whole Foods has closed stores in San Francisco, Chicago and elsewhere over the last 12 months, but supermarkets remain a driver for Amazon’s brick-and-mortar sales growth—the company opened 11 Whole Foods and 21 Amazon Fresh locations in 2022.

Amazon CEO Andy Jassy said in the letter that the company continues to invest in Whole Foods "while also making changes to drive better profitability.”

“Whole Foods is on an encouraging path, but to have a larger impact on physical grocery, we must find a mass grocery format that we believe is worth expanding broadly,” Jassy wrote. “Amazon Fresh is the brand we’ve been experimenting with for a few years, and we’re working hard to identify and build the right mass grocery format for Amazon scale. Grocery is a big growth opportunity for Amazon.”

Jassy referred to the “somewhat unusual, but significant grocery business” Amazon has built over the last 20 years, initially focusing on products that did not require temperature control. “However, we offer more than 3 million items, compared to a typical supermarket’s 30,000 for the same categories. To date, we’ve also focused on larger pack sizes, given the current cost to serve online delivery,” Jassy said.

The company aims to broaden the scope of its grocery offering, though, which will require an expanded physical store footprint, Jassy said, adding that most grocery shopping still takes place in brick-and-mortar stores.

"Over the past year, we’ve continued to invest in the [Whole Foods] while also making changes to drive better profitability. Whole Foods is on an encouraging path, but to have a larger impact on physical grocery, we must find a mass grocery format that we believe is worth expanding broadly. Amazon Fresh is the brand we’ve been experimenting with for a few years, and we’re working hard to identify and build the right mass grocery format for Amazon scale. Grocery is a big growth opportunity for Amazon.”

He noted that some other efforts in grocery have failed to produce the returns the company anticipated, such as the deal that offered free shipping for grocery orders over $35. "[W]e looked at some programs that weren’t producing the returns we’d hoped and amended them,” he said. “We also reprioritized where to spend our resources, which ultimately led to the hard decision to eliminate 27,000 corporate roles.”

It addition to the expansion of its brick-and-mortar presence, Amazon has also made inroads with grocery shoppers through its expansion into pharmacy and health care with the launch of Amazon Pharmacy in 2020 and the purchase of primary care provider One Medical in 2022. Amazon most recently launched “Coupons on Amazon Pharmacy,” a service that allows patients to receive any available coupons automatically for pharmaceutical drug purchases made through Amazon Pharmacy. The company also recently launched RxPass, which provides a variety of common medications for $5 a month.

About the Author

You May Also Like

.webp?width=300&auto=webp&quality=80&disable=upscale)