Walmart Stores: Helping Consumers Navigate a Transforming Economy

APRIL 2009 EXECUTIVE OVERVIEW IRI's Times & Trends highlights new developments and critical events across all major CPG categories and channels, providing powerful benchmarking data to help guide your strategic decisions. This report explores Walmart’s ...

May 4, 2009

APRIL 2009

EXECUTIVE OVERVIEW

IRI's Times & Trends highlights new developments and critical events across all major CPG categories and channels, providing powerful benchmarking data to help guide your strategic decisions. This report explores Walmart’s role in helping consumers navigate through difficult economic times and what this means for manufacturers and competing retailers.

Introduction

For several years, Wal-Mart Stores, Inc. pursued an aggressive supercenter expansion plan which contributed heavily to remarkable global sales performance. After a time, though, the plan began to bring increasing cannibalization of existing stores. The time had come to regroup.

And the retailer did just that: Wal-Mart began charting a new plan for growth. While selectively reducing domestic expansion efforts (the company continued aggressive international expansion), the retailer began placing a heavier focus on driving growth within existing operations-- more efficient inventory systems, more competitive pricing strategies, and more aggressive in-store marketing initiatives.

Throughout the recession, Walmart has maintained focus. A new merchandising strategy, ‘win, play, show,’ is enabling the retailer to focus on the most promising categories and products in order to drive scalability. And ‘fast, friendly, clean’ is aimed at creating “the ideal customer experience.”

Walmart’s mission statement, “Save Money. Live Better.,” is well-suited for consumers struggling to balance the needs of daily life with the harsh realities of a recessionary economy.

Select Findings

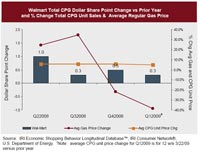

Despite falling gas prices, budget-strapped consumers continue to allocate an increasing share of CPG spending to Walmart. When gas and CPG prices spiked at the end of 2007/beginning of 2008, Walmart share of spending soared. At the end of 2008, gas prices dropped sharply, but Walmart continues to capture increased share of spending. IRI’s Times & Trends explains the reasons for this trend.

Over the past year, Walmart captured increasing share in 59 of the top 100 CPG categories. The retailer is demonstrating an ability to capture increased share across key meal component and ingredient categories, and across categories which have experienced particularly high price increases over the past year and a half.

See the complete report in the "Walmart Stores: Helping Consumers Navigate a Transforming Economy" pdf.

You May Also Like