Steve Burd, Game ChangerSteve Burd, Game Changer

The soon-to-retire executive transformed Safeway, and now he’s ready for his next challenge “Health care costs are rising and out of control. We’ve dealt with that problem at Safeway, and I believe that what we’ve done here will work for the rest of the country.”

May 6, 2013

Steve Burd plans to try to change the world after he leaves Safeway.

Once he officially retires next week after just over 20 years as the Pleasanton, Calif.-based chain’s chairman and chief executive officer, Burd said he plans to stay on to see Safeway’s long-awaited wellness initiative through, after which he will devote most of his time to reforming the U.S. health care system.

“People say we need to find a better way to deal with health care, and now that we’ve found a better way at Safeway, we want to share it with the nation,” Burd told SN. “It will take time, but ‘changing the world’ is a fair statement, as long as we begin small.”

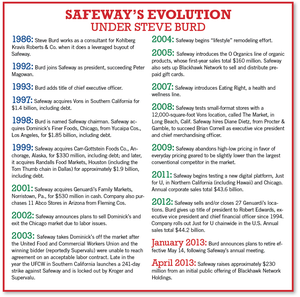

Timeline: Safeway’s Evolution Under Steve Burd

Though his formal retirement from Safeway is imminent, Burd expects to remain with the company for several months, probably through the end of the year, he noted — to provide continuity for the wellness initiative, which he said has occupied most of his time for the past two years.

Steve Burd speaking at a 2009 conference introducing the Coalition to Advance Healthcare Reform. Photo by Getty Images

“Though I will retire May 14, I’ve made a commitment to the board that I will see the wellness program through for an indeterminate amount of time. After that, regional management will be able to pull off the program and see it grow.”

Burd said he will resign from the Safeway board next week. “It will be good to leave the board and give the next CEO the opportunity to do his job without having to work in my shadow,” he explained.

However, he said he will remain a member of the board of Blackhawk Network — the prepaid gift-card business Safeway introduced eight years ago —“because Bill Tauscher, the CEO of Blackhawk, asked me to stay to provide real continuity.”

Once he does officially leave Safeway, Burd said he plans to set up an office “and go to work every day,” spending more time talking with people he has already pinpointed who have similar ideas about health care, “and then parceling out the workload.”

“It will take a village to get the job done,” he acknowledged.

Burd said he already has a cadre of medical professionals with whom to form the village. “I’ve met so many brilliant medical people over the years, and with my business background and their medical expertise, I believe we can do things none of us can do ourselves.

“I’ve developed a real passion for this undertaking, and I’ve met people who respond to what I bring to the table, and now I’ll have the opportunity to put more effort into it.

“The clinicians I talk to say they can’t reinvent the U.S. health care system, but they tell me they think I can. And I think I can — but not without their knowledge. If I can combine their knowledge with my business skills, then I believe we can work with Congress to change health care.

Burd’s interest in addressing rising health care costs gets him an audience with President Obama. Photo by Getty Images

“I speak with CEOs all over the world about the value of getting 30 big companies to develop and implement health care plans similar to Safeway’s and then to bring the results to Congress, and there are a lot of CEOs who are interested in doing that.”

He sees many different avenues to pursue his goal, he noted, “and I’m not sure at this point which one I will choose, but it will be the one that gives me the best chance to change the world, starting with North America.

“Health care costs are rising and out of control. We’ve dealt with that problem at Safeway, and I believe that what we’ve done here will work for the rest of the country.”

According to Burd, 70% of health care costs come from behavior-related issues, so by encouraging employees to change their behaviors — for example, losing weight, quitting smoking, lowering fat or salt intake — and then lowering their insurance premiums if they do, Safeway has been able to keep health care costs flat since 2005 — a period during which other U.S. companies have seen rates rise 8%, he pointed out.

“We feel Safeway now has one of the healthiest workforces in the nation, and we’re just one example of changing things one step at a time,” Burd said.

Read more: Steve Burd's Power 50 Profile

He said he believes Safeway has already helped change the way the U.S. approaches health care by influencing Congress to add an amendment to the Affordable Health Care Act — ultimately called the Safeway Amendment — that will allow businesses to increase the level of incentives to encourage healthier employee behavior, from the 20% discount allowed under current law to 30% next January, with the option of eventually increasing it to 50%.

Burd said he came by his interest in health care after a bout with prostate cancer 12 years ago — a process that introduced him to medical people at the University of California, San Francisco, which he described as “one of the nation’s top medical centers for cancer research.”

As a result of his personal experience, Safeway has raised approximately $192 million for cancer research at store level over the last decade, Burd pointed out.

Family Time

Though he plans to devote most of his post-Safeway efforts to health care matters, Burd, 63, said he also intends to spend more time with his family. “Part of the reason for retiring from Safeway now is that I’ve reached a point where I need more personal time with my wife of 40 years,” he said.

“I want to take 10 to 12 weeks a year to do whatever we want and then spend the other 40 weeks working as hard as I’ve ever worked to try to solve the nation’s health care issues.

“I still have a lot of energy — the same kind of energy I had 20 years ago — and I’m still very passionate about things I choose to do, which is quite different from being emotional,” he noted.

Steve Burd speaks during a Senate Heath, Education, Labor and Pensions committee hearing in 2009. Photo by Getty Images

“The supermarket industry is very different from any others I’ve been in, and it’s the pace that has been fun. But I’m sure in my new work I will find things to replace that — though that work will be more contemplative and thoughtful and solutions-oriented and will require a different pace. But I think it still will be very fascinating.”

Burd, whose background is economics, came to Safeway after working as a consultant with Kohlberg Kravis Roberts & Co. following its leveraged buyout of Safeway in 1986.

“So when I came here fulltime, the advantage I brought was that I had a 10-year history of getting inside companies, studying them quickly and then giving advice on how to proceed.

“I had worked with 17 companies in 11 industries over the prior six months, so I was a quick study, and I knew the questions to ask that may not have been raised by someone already inside the company, and I think asking those questions at Safeway probably helped the business.

“What I brought with me to Safeway was a real culture of thrift and an understanding that pennies and dollars count in a low-margin business.”

Burd said he has thoroughly enjoyed his 20 years at Safeway. “It’s been a lot of fun for me,” he noted.

“This is a very tough business, but despite all the challenges, it’s fun meeting those challenges and having success — and Safeway is a company that’s had a fair amount of success.

A Steve Burd timeline: Click on the image for a larger verison.

“It’s been tough the last couple of years, but we’ve built a strong program that should produce great results for the next several years, which is what I wanted to do before I hung up my apron — to make sure the company was positioned to grow once I left — and I believe Just for U, the fuel initiative and the wellness initiative are critical to making that happen.

“I said I would stick around until those programs were in a position to be executed, so now is a good time for me to leave in terms of where the organization sits.”

What he will miss most about Safeway, he said, is the people. “The management team has my stamp on it, with every senior executive having been recruited by me from inside or outside the company, and I will miss the daily stimulation they provide.

“This business is very decision-intensive, and there’s always a lot going on, so we have to move quickly, and I will miss that.”

Burd told investors in March he intends to retain his personal investments in the chain. “I believe in the prospects for Safeway because of the initiatives we’ve started and how exceptional they are.

“So though I won’t be a member of management, my plan is to keep the vast majority of my shares in Safeway because I think they’re going to be more valuable two, three and five years from now.”

Safeway's Future Secure

Burd told SN he believes Safeway’s longtime future is assured.

“The company is pursuing a strategy we believe will be very successful as it continues to concentrate on points of differentiation that consumers find valuable,” Burd explained.

“We’re quite pleased with the early stages of the Just for U platform, which has been instrumental in building market share for four quarters.

“We plan to transform the company with the wellness play, and that transformation is going to take a tremendous effort to execute, but it should lead to good results and further points of differentiation.”

Burd’s emphasis on wellness is on display at Safeway stores. Photo by Kristen Loken

Asked about the impact Safeway has had on the rest of the supermarket industry during his years at the helm, Burd said, “We’ve done a number of things that others have copied.

“For example, some of the work we’ve done in store design — to create our lifestyle stores — has been replicated by others.

“We’ve always been strong in private label, and we’ve developed several strong new brands — O Organics, Eating Right and Open Nature, for example — that have had an influence on some competitors.

“Safeway also played a big role in industry consolidation, and that facilitated moves by others.

“We also created Blackhawk, and that has had a powerful influence on the industry because all supermarkets in the country now carry prepaid gift cards as part of their product offering.”

As to whether he’d rather be starting his career at Safeway now than when he did in 1992, Burd expressed ambivalence.

“I think 1992 was a great time to start because I knew Safeway reasonably well after working on the [1986] leveraged buyout, and I recognized then that it was a company with a lot of opportunities that were appealing to me.

Read more: Edwards' Promotion Ensures Continuity

“Today thing are different, but Safeway is still a company with a lot of opportunities going forward, so it might be fun to enter the business now because what I enjoy is building something and creating shareholder value, and that is as relevant today as it was 20 years ago.”

Sidebar: Lessons Learned

Steve Burd has no regrets about his years at Safeway and the decisions he’s made, he told SN.

“I can say with certainty that I’ve enjoyed every minute of the last 20 years,” he noted. “I haven’t had a single bad moment because I take the bad news the same way I take the good news.”

One of things he’s most proud of, he acknowledged, is the fact that, in a highly competitive industry that has seen a lot of new operators come in, total shareholder returns at Safeway have outperformed the S&P 500 by about 40% over the last 20 years.

“I’ve always focused on shareholder value because that is the mission of management and of every employee,” Burd said.

Photo by Kristen Loken

Looking back, he said he would be hard-pressed to indicate what he felt was the high point of his years at Safeway.

“It’s tough to pick a highlight because I’m the kind of person that doesn’t have highs and lows — I have a very steady demeanor — so for me to identify one or two highlights would be difficult because there have been so many.”

Asked what he might have done differently during his tenure, knowing what he knows now, Burd said, “I don’t think I would have done anything differently among the big things, though looking back at the little things that happen as you move through a quarter or a year, there are always things you wish you had done differently, or perhaps sooner.

“For example, there are some things I might wish we had done at the district level before going to the division level.

“But there are no strategic moves that have bothered me over the 20-year period.”

Reviewing the chain’s acquisition strategy and its mixed results, Burd said, “You always learn from the things you do, and one of the things I’ve thought I might have done differently if we acquired a family-owned business is that we would probably contract with the family members to stay with the business for the first five years.

“Having acquired several family-owned businesses, I’ve become smarter, and that may be the biggest thing I would want to do differently because Americans have a soft spot for smaller, family-owned businesses,” he explained.

Burd said the results at each of Safeway’s acquisitions “correlate closely with how much personal time senior management spent on putting the deal together because we learned every step of the way.

“When we acquired Vons [in 1997], I visited the company 30 times in the first 18 months. On every visit I talked to the people there about best practices they could pursue and also about best practices they were pursuing that could help Safeway, and that was good for both organizations.

“Usually you look at your own best practices and apply them to an acquired company, but it seemed important to determine what Vons was doing better and then applying that to our own company, which was three times the size of Vons.

“But each situation is different, and you must do what’s right.”

He said Safeway followed the same approach that had worked at Vons when it acquired Carrs in Alaska in 1998 and Randalls and Tom Thumb in Texas in 1999.

However, he said the company’s efforts after acquiring Dominick’s in Chicago in late 1998 were disrupted by a labor dispute, and its experience with Genuardi’s in the Philadelphia area [acquired in 2000] is what got him thinking about keeping family members as part of the organization during a transition period, he noted.

Sidebar: Watching the Clock

For Steve Burd, speed wins.

According to the retiring chairman and chief executive officer of Safeway, Pleasanton, Calif., setting challenging goals with tight deadlines is the best way to operate in the supermarket business.

“I believe in always setting big goals that most people would consider impossible to achieve and setting a timeframe that appears unrealistic,” he told SN, “because what that does is it forces you to think about the problem differently than you might have with more time.

“I’ve always believed that speed is important. Speed wins.

Photo by Kristen Loken

“This is a very fast-paced, decision-intensive business — more so than any other business I’ve been involved with. Business decisions are made every day at every level of the company — some by store managers, who make more decisions in a day than I have to make in a month.

“And speed depends on perspective. For example, about three years ago Safeway had the best results at reducing shrink of anyone in the sector — cutting shrink by $500 million — and I established a goal to cut another $300 million of shrink over the following 18 months.

“You would think that most of the low-hanging fruit was already gone, and it looked like an impossible target. But we broke the challenge down into nine discrete areas in the store — dairy, bakery and produce, for example — and gave the organization nine weeks to develop a plan to cut that additional $300 million.

“Most companies would have taken one department and come up with a plan in four months and then spent the next two years to execute it. But speeding the process up, we did what we set out to do within the 18-month timeframe, and we had a lot of fun hitting our targets.”

The delay in getting Safeway’s wellness project going — from an original launch date set for the end of 2012 — does not contradict Burd’s belief in the value of speed, he said.

“The wellness initiative involves a lot of technical innovation, and that doesn’t always happen in a straight path,” he explained.

“You’ve got to have patience, and we can do what we have to do to get ready, but our partner has to do what he has to do, and then we have things we need to do together.

“So the delay is not a big deal, and it doesn’t violate the tenet that speed wins. We go after each project with speed, but sometimes we run into bumps in the road that we have to deal with — that’s just the way it goes.”

Sidebar: Analysts Cite Burd's Impact

Steve Burd brought cost disciplines to Safeway that have helped it prosper over the last 20 years, though those disciplines may have hurt the company in the acquisitions it made, industry analysts told SN.

Burd’s most lasting legacy, however, may be the way he taught the industry to deal with labor unions, they added.

“Certainly supermarkets were not afraid to take strikes before 2003,” John Heinbockel, managing director for Guggenheim Securities, New York, said. But during the course of a 241-day strike-lockout in Southern California that lasted from late 2003 into early 2004, “Burd took the lead in how conventional chains approach labor contracts,” he explained.

“Steve looked at [the strike] as an investment — something worth doing if conventional chains were going to change the way they deal with labor.

Burd said his work in the “Lifestyle” store design has influenced the industry. Photo by Kristen Loken

“The Southern California strike was so visible and so expensive for everyone, and it changed the trajectory for the whole industry in dealing with cost inflation.

“As a result of the stance Burd took, there have been only a very small number of strikes since then, compared with an average of a couple of year before 2003.”

Chuck Cerankosky, managing director for Northcoast Research, Cleveland, offered a similar assessment. “Steve Burd stood fast during the lengthy Southern California strike in 2003 and 2004, and that was an important event for the industry.”

In terms of the disciplines Burd brought to Safeway, analysts were unanimous in their positive comments.

“He was exactly what Safeway needed,” Karen Short, managing director for BMO Capital, New York, said — “someone who impose cost controls and disciplines to the company, which enabled him to make significant improvements in the health of the business.”

According to Heinbockel, “When Burd came to Safeway, it was not in particularly good shape. It was a company struggling with debt from the 1986 leveraged buyout and little differentiation, and it had a high cost structure and very low EBITDA margins.

“But during Burd’s first five or six years, before Safeway began making acquisitions, margins doubled and comps were terrific, and the value he created in the stock was off the charts.

“He took a business that was in difficult shape and made it one of the stronger players in the industry. There probably aren’t a lot of people who could have done what he did — perhaps because he brought a non-traditional, outsider’s view of how to cut costs without hurting service and how to differentiate the shopping experience. By the mid-1990s, Safeway was a powerhouse.”

Jonathan Ziegler, a retired industry analyst who followed Safeway during Burd’s early years, offered similar comments.

“When Steve joined Safeway, the company was loaded with debt from the LBO six years earlier. And while Safeway was able to take advantage of superior locations in densely populated areas, it was not doing well cultivating customers to drive sales, so Steve focused on customers and on driving sales with merchandising, marketing and promotions.

“He corrected serious out-of-stock problems and dealt with shrink in large part by moving more perishable products.

“He was also very creative in trying to make the stores more productive long before the lifestyle upgrades.”

Safeway’s record on acquisitions has been the least successful aspect of Burd’s tenure, the analysts said.

“The good news about the acquisitions was, Safeway brought in its own people to run them,” Ziegler said. “The bad news was, it didn’t maintain the basic disciplines of buying right for each acquisition.

“Genuardi’s, for example, was a company that was very special to the people in the Philadelphia area, but under Burd’s direction, the company ‘Safeway’d’ those stores and lost traffic doing so in its efforts to be more cost-effective.

“Putting Safeway Select into the stores may have made good business sense, but Genuardi’s had its own brands that consumers liked, and the Safeway brand didn’t go over so well.”

Short offered a similar viewpoint. “Steve is highly intelligent, but he is not a merchant, and though he brought the same cost disciplines to the companies the chain acquired, it also ‘Safeway-ized’ those companies, which resulted in market-share losses because it put too many Safeway elements into the stores, which prompted customers to pull back.”

According to Heinbockel, “It’s always challenging for any company to go into a new market. Continuity of management is important because those people know the local market really well, and it’s better to take a strong regional brand with healthy ties to the local consumer and add programs slowly so you don’t shock the customer.

“One thing Safeway learned from its acquisitions is that it needed to go slower and change less at the outset in terms of what customers see.”

Join SN's LinkedIn Group to network with industry professionals.

The analysts give Burd higher marks for the lifestyle upgrades he engineered.

“People had opened similar stores before,” Heinbockel said, “but Burd went about it in a different, more concentrated way — cramming all the remodels into a six- or seven-year period and making all stores uniform and identifiable as a brand.”

According to Ziegler, “The decision to remodel stores in the lifestyle format was the way Burd chose to deal with the growth of Wal-Mart, and it proved to be very effective.”

However, while acknowledging that upscaling the stores was “probably the right decision,” Short said it gave Safeway “an excuse to keep prices high, and that’s came back to haunt the company in the last few years.”

About the Author

You May Also Like