The food and beverages that help Americans make it through the day most efficiently posted gains during the 52 weeks that ended June 16, 2013.

Take, for instance, caffeinated beverages. Riding the success of single-serve coffee pods, coffee sales climbed 7.4% across a multi-outlet geography that includes supermarkets, drug stores, mass merchants (including Wal-Mart Stores), military commissaries and select dollar and club chains. Energy drinks likewise improved their sales stamina, rising 7.2%.

20 KEY CENTER STORE CATEGORIES

Supermarket dollar sales and percent change for the 52 weeks ending June 16, 2013, by Information Resources Inc.1-Carbonated Soft Drinks — $11.4B, -2.4

2-Fresh Bread and Rolls — $9.3B, -2.1

3-Salty Snacks — $9.0B, 2.7

4-Beer — $8.9B, 3.4

5-Wine — $6.6B, 4.2

6-Cold Cereal — $5.7B, -2.7

7-Frozen Dinner/Entrees — $5.5B, -4.5

8-Bottled Water — $4.4B, 4.1

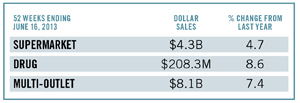

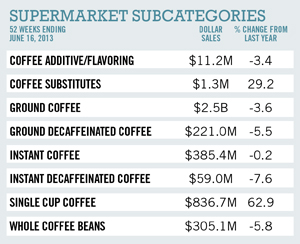

9-Coffee — $4.3B, 4.7

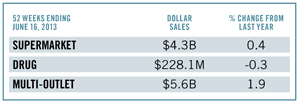

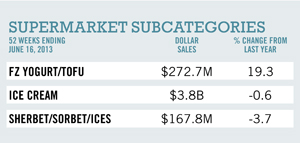

10-Ice Cream/Sherbet — $4.3B, 0.4

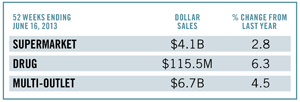

11-Crackers — $4.1B, 2.8

12-Cigarettes — $4.0B, -5.1

13-Cookies — $3.9B, 3.0

14-Soup — $3.8B, 2.2

15-Chocolate Candy — $3.3B, 3.7

16-Bottled Juice — $3.2B, -4.3

17-Spirits/Liquor — $2.9B, 13.8

18-Peanut Butter — $1.2B, 10.6

19-Energy Drinks — $1.0B, 6.0

20-Premixed Cocktails/Coolers — $227.3M, -0.9

Handheld snacks that lend themselves to on-the-go eating and products that provide sustenance also gained traction. Sales of crackers with filling rose 6% in supermarkets; ready-to-eat popcorn was up 16.3%; and peanut butter increased 10.6%.

Alcoholic beverage innovation is another sales-driving trend, as marketers cater to experimental Millennials with sweeter varietals, hard ciders and dessert-flavored liquors. Sales of wine, beer and spirits were up 5.2%, 4.6% and 6.8% respectively, across multi-outlets.

READ MORE:

Data Table: 300+ Categories by Dollar, Unit Sales

• Category Guide Introduction: Signs of Life

• Fresh Market Categories on Solid Ground

• Healthy Growth in Some Nonfood Categories

CSDs, Fresh Bread/Rolls, Salty Snacks, Beer, Wine

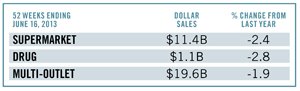

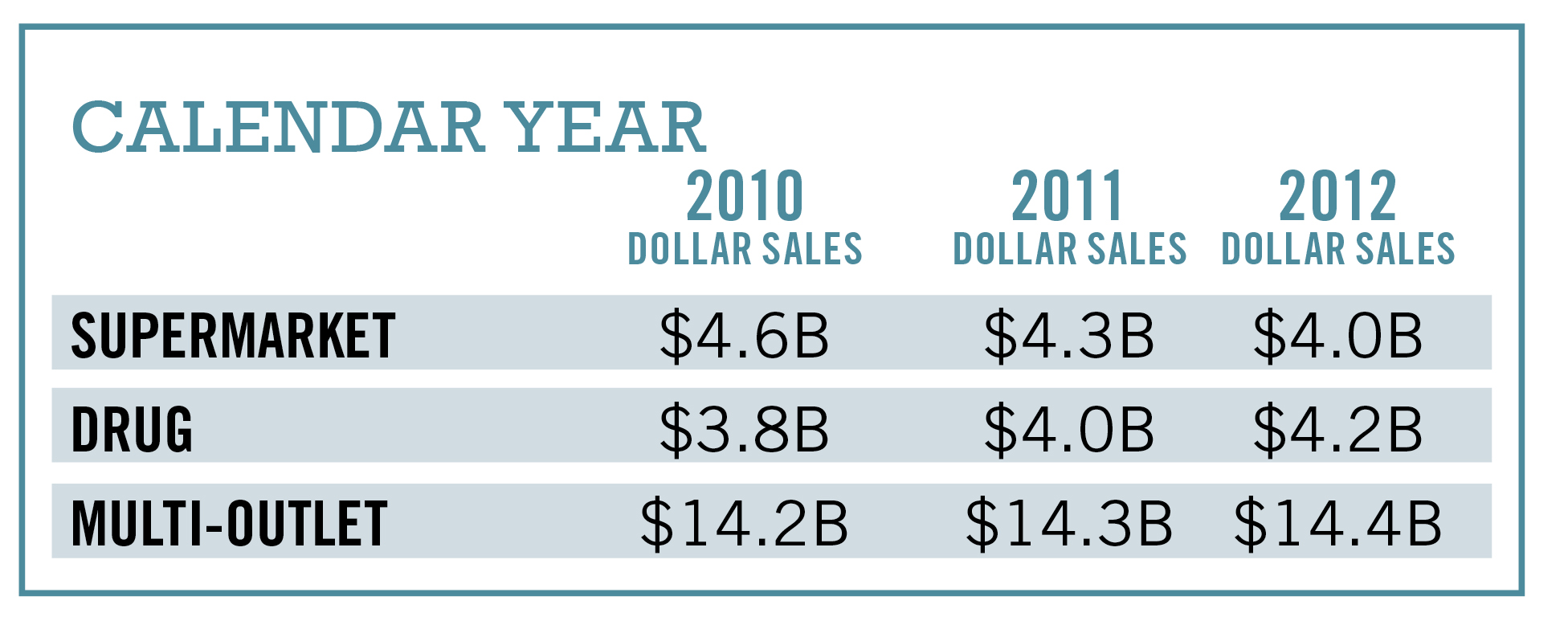

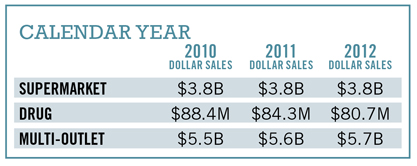

Carbonated Soft Drinks

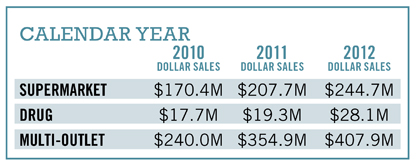

Per capita consumption of soda trumped bottled water in 2012 with the average American guzzling 42 gallons of carbonated soft drinks vs. 31 gallons of bottled water, according to the International Bottled Water Association. But consumers’ thirst for fizzy refreshment wasn’t enough to avert a dollar sales drop across supermarkets, drug stores and a new multi-outlet geography tracked by IRI comprising supermarkets, drug stores, mass merchants including Wal-Mart Stores, military commissaries and select dollar and club retail chains.

Per capita consumption of soda trumped bottled water in 2012 with the average American guzzling 42 gallons of carbonated soft drinks vs. 31 gallons of bottled water, according to the International Bottled Water Association. But consumers’ thirst for fizzy refreshment wasn’t enough to avert a dollar sales drop across supermarkets, drug stores and a new multi-outlet geography tracked by IRI comprising supermarkets, drug stores, mass merchants including Wal-Mart Stores, military commissaries and select dollar and club retail chains.

Soda sales have dipped along with merchandising support for CSDs. In fact, among the 10 largest Center Store categories, the sharpest decline in merchandising support was linked to carbonated beverages, with share of volume sold on promotion dropping 2.9%, according to IRI’s “Center Store: Driving Growth From the Inside Out” Times & Trends report. The prevalence of private labels are partly to blame since corporate brands don’t get as much merchandising support as brand-name soda. And while some large banners don’t promote the category heavily, other chains focus on sales-boosting strategies.

Soda sales have dipped along with merchandising support for CSDs. In fact, among the 10 largest Center Store categories, the sharpest decline in merchandising support was linked to carbonated beverages, with share of volume sold on promotion dropping 2.9%, according to IRI’s “Center Store: Driving Growth From the Inside Out” Times & Trends report. The prevalence of private labels are partly to blame since corporate brands don’t get as much merchandising support as brand-name soda. And while some large banners don’t promote the category heavily, other chains focus on sales-boosting strategies.

Kowalski’s Markets, for instance, has found success selling portion control, mini cans containing between 90 and 100 calories. They are the fastest-growing CSD segment at the family-owned chain.

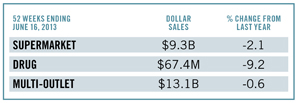

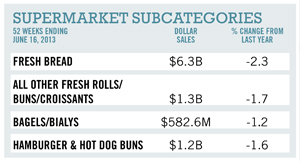

Fresh Bread and Rolls

Has the low-carb craze resurfaced? Not exactly, but dollar sales of bread and rolls have dipped in multiple outlets despite rising promotional activity, according to IRI. A number of factors are contributing. Among them is Americans’ predilection for snacking throughout the day on Greek yogurt, granola bars and other mini-meals that preempt a need for this lunchtime staple.

Has the low-carb craze resurfaced? Not exactly, but dollar sales of bread and rolls have dipped in multiple outlets despite rising promotional activity, according to IRI. A number of factors are contributing. Among them is Americans’ predilection for snacking throughout the day on Greek yogurt, granola bars and other mini-meals that preempt a need for this lunchtime staple.

More ethnically diverse cuisine is also eating into breads’ slice of the pie, as rice and corn-based foods occupy an increasing portion of the plate.

More ethnically diverse cuisine is also eating into breads’ slice of the pie, as rice and corn-based foods occupy an increasing portion of the plate.

Then there is the plethora of fast and easy lunchtime options as frozen-food manufacturers continue to innovate, and quick-service restaurants adopt breadless menu options.

Though tasty loaves were once categorized as comfort food, good-for-you ingredients are transforming bread into a nutrient vehicle for sprouted, ancient and whole grains.

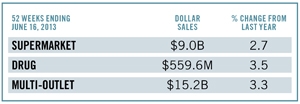

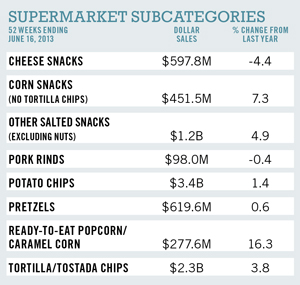

Salty Snacks

Americans are eating salty snacks by the handful, with 66% reporting they purchased the same amount or more between 2011 and 2012, according to a Mintel consumer poll. But about one-third of Americans have scaled back with 34% reporting that they’ve reduced salty snack purchases.

Americans are eating salty snacks by the handful, with 66% reporting they purchased the same amount or more between 2011 and 2012, according to a Mintel consumer poll. But about one-third of Americans have scaled back with 34% reporting that they’ve reduced salty snack purchases.

Of those who are consuming less, nearly two-thirds (64%) said they reduced their intake because products in the category are unhealthy/fattening, and 36% because they’re too expensive.

Healthy options are on the rise as manufacturers churn out better-for-you pretzels, popcorn and chips. Health claims dominated the 745 product launches measured during the year ending Nov. 30, 2012, according to Mintel.

Healthy options are on the rise as manufacturers churn out better-for-you pretzels, popcorn and chips. Health claims dominated the 745 product launches measured during the year ending Nov. 30, 2012, according to Mintel.

Snacks like popcorn — with sales up more than 16% in supermarkets — have likely benefited from their whole grain status and ability to carry bold flavors. Portability is also key, as 45% of consumers want snacks they can eat on the run.

The cost of salty snacks appears to be rising, with dollar sales increasing 5.6% across supermarkets, drug stores, mass merchants, military commissaries, select dollar and club channels and convenience stores during 2012. Unit sales fell 0.6%.

The cost of salty snacks appears to be rising, with dollar sales increasing 5.6% across supermarkets, drug stores, mass merchants, military commissaries, select dollar and club channels and convenience stores during 2012. Unit sales fell 0.6%.

Potato chips, tortilla chips and popcorn lead salty snack purchases with 89% of Mintel respondents reporting having bought potato chips for someone in their household during the past six months; 75% purchased tortilla chips; and 75% bought popcorn.

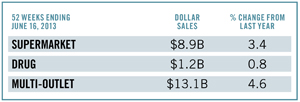

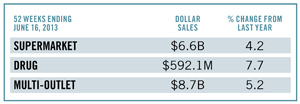

Beer

Just as craft brewers play to beer enthusiasts’ exploratory nature, supermarkets are pushing the envelope with merchandising strategies that encourage experimentation and incremental sales in the fast-growing craft segment.

Just as craft brewers play to beer enthusiasts’ exploratory nature, supermarkets are pushing the envelope with merchandising strategies that encourage experimentation and incremental sales in the fast-growing craft segment.

Piggly Wiggly, Price Chopper Supermarkets and H-E-B are among those getting their feet wet with growler pours. By selling beer on tap for off-premise consumption, supermarkets are adding an artisanal feel to their offering. Growler pours also allow retailers to help beer drinkers discover obscure brews that are not otherwise available for retail distribution.

There is a plethora of untapped potential considering the number of craft brews that are not available in bottle form. Whereas global brewers sell about 10% of their beer in draft form, 30% of craft beer is sold on tap, according to Julia Herz, craft beer program director for the Brewers Association, Boulder, Colo. According to Brewers Association data, craft beer sales climbed during the first half of 2013, with dollar sales up 15% and unit sales 13%.

There is a plethora of untapped potential considering the number of craft brews that are not available in bottle form. Whereas global brewers sell about 10% of their beer in draft form, 30% of craft beer is sold on tap, according to Julia Herz, craft beer program director for the Brewers Association, Boulder, Colo. According to Brewers Association data, craft beer sales climbed during the first half of 2013, with dollar sales up 15% and unit sales 13%.

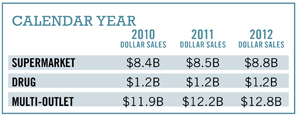

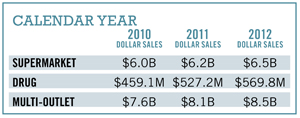

Wine

Wine sales are on the rise in supermarkets (4.2%), drug stores (7.7%) and IRI’s multi-outlet geography (5.2%) comprising supermarkets, drug stores, mass merchants (including Wal-Mart Stores), military commissaries and select dollar and club chains.

Wine sales are on the rise in supermarkets (4.2%), drug stores (7.7%) and IRI’s multi-outlet geography (5.2%) comprising supermarkets, drug stores, mass merchants (including Wal-Mart Stores), military commissaries and select dollar and club chains.

Part of the growth may be attributed to new and innovative selling strategies like wine on tap. At a time when 33% of shoppers agree that “grocery shopping is a bore,” according to ad agency Barkley, Heinen’s Fine Foods allows shoppers to enjoy a glass of wine anywhere in the store.

To access the self-serve tap, shoppers purchase a card and have their age verified at the customer service desk. At Heinen’s, wines range from 99 cents to $11.99 depending on varietal and quantity tasted. Shoppers can select 1-, 2- or 4-ounces.

To access the self-serve tap, shoppers purchase a card and have their age verified at the customer service desk. At Heinen’s, wines range from 99 cents to $11.99 depending on varietal and quantity tasted. Shoppers can select 1-, 2- or 4-ounces.

Amenities like these make for a novel shopping experience, but the ability to try-before-you-buy also leads to incremental sales.

Skype-led wine tastings are another way retailers are building excitement in the category. Dierbergs Markets in Chesterfield, Mo., recently coordinated a wine dinner with Tyler Florence featuring the chef’s wines.

Events like these are helping educate Millennial consumers. Many are inexperienced with wine but eager to experiment.

Cold Cereal, Frozen Dinner/Entrees, Bottled Water, Coffee, Ice Cream/Sherbet

Cold Cereal

Cereal sales are down due to increased competition from more portable options.

Cereal sales are down due to increased competition from more portable options.

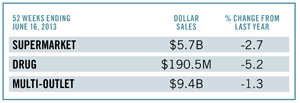

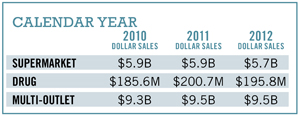

But sales declines in supermarkets (2.7%), drug stores (5.2%) and multi-outlets (1.3%) tracked by IRI are not new, according to analysts.

“Flat sales and declining volumes over the past decade indicate consumers are tiring of boxed cereals,” said Nicholas Fereday, an analyst with Rabobank. “They are being lured away by more contemporary, aspirational and convenient morning eating options in other grocery aisles or restaurants.”

In addition to breakfast being a new eating-out occasion, rising snacking incidences are transforming breakfast into “snackfast,” according to a Rabobank report, and consumers are seeking convenience and portability. Protein-rich options are also carrying busy Americans through their hectic day. Declining birth rates are also affecting sales since children are the main cereal-eating demographic.

In addition to breakfast being a new eating-out occasion, rising snacking incidences are transforming breakfast into “snackfast,” according to a Rabobank report, and consumers are seeking convenience and portability. Protein-rich options are also carrying busy Americans through their hectic day. Declining birth rates are also affecting sales since children are the main cereal-eating demographic.

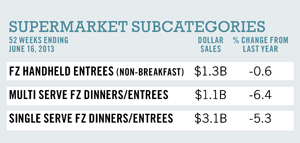

Frozen Dinner/Entrees

With inventive flavors and innovative package types, frozen dinners and entrees are more convenient than ever.

With inventive flavors and innovative package types, frozen dinners and entrees are more convenient than ever.

And though time-crunched shoppers crave the instant gratification that these meals provide, many are also seeking solutions that allow them to customize meals or at least have a hand in their preparation.

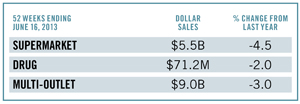

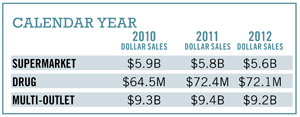

With sales down 4.5% in supermarkets, frozen dinners and entrees are facing competition from shelf-stable dinner kits, according to Sue Viamari, editor of IRI’s Times & Trends report.

With sales down 4.5% in supermarkets, frozen dinners and entrees are facing competition from shelf-stable dinner kits, according to Sue Viamari, editor of IRI’s Times & Trends report.

Kraft recently launched the Kraft Recipe Maker line that’s designed to complement fresh proteins and vegetables, in flavors like Verde Chicken Enchilada. Frozen-food makers like Nestlé are capitalizing on the trend with Lean Cuisine Salad Additions, a frozen line of salad add-ins. Just add lettuce varieties like Cranberry & Chicken Salad make up the line.

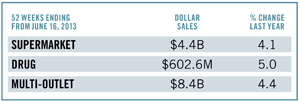

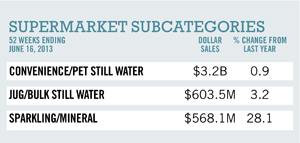

Bottled Water

Bottled water has made a comeback with sales climbing a refreshing 4% in supermarkets during the 52 weeks ending June 16, 2013.

Bottled water has made a comeback with sales climbing a refreshing 4% in supermarkets during the 52 weeks ending June 16, 2013.

Increased demand is driving the trend as more Americans swig bottled water than in years past. Consumption climbed 6.2% to 31 gallons per person in 2012, according to the International Bottled Water Association.

The category is among Center Store’s fastest growing with dollar sales up 6.7% across multi-oulets including convenience stores in 2012 vs. 2011, according to IRI. To help grow their share, supermarkets have employed a range of strategies. ShopRite displays pallets of bottled water in high traffic areas near its delis, while C&K Market places single cases in otherwise empty shopping carts, as a customer convenience.

The category is among Center Store’s fastest growing with dollar sales up 6.7% across multi-oulets including convenience stores in 2012 vs. 2011, according to IRI. To help grow their share, supermarkets have employed a range of strategies. ShopRite displays pallets of bottled water in high traffic areas near its delis, while C&K Market places single cases in otherwise empty shopping carts, as a customer convenience.

Coffee

The buzz in coffee is all about pods.

The buzz in coffee is all about pods.

Sales in the single-cup subcategory skyrocketed 62.9%, sending overall coffee sales up 4.7%.

In addition to increased availability there are more affordable options now that national-brand patent expirations have opened the market to private-label coffee pods.

Kroger Co. sells single-cup coffee capsules that are compatible with Keurig single-cup brewers under its Private Selections brand. Safeway also sells Keurig-compatible Safeway Select “OneCups.”

Kroger Co. sells single-cup coffee capsules that are compatible with Keurig single-cup brewers under its Private Selections brand. Safeway also sells Keurig-compatible Safeway Select “OneCups.”

New machines are on the market too. Last year, Green Mountain Coffee Roasters launched the Keurig Vue Brewing system, which is only compatible with Vue coffee packs.

Ice Cream/Sherbet

Frozen Greek yogurt is the breakout star of the ice cream/sherbet category.

Frozen Greek yogurt is the breakout star of the ice cream/sherbet category.

Frozen Greek yogurt helped drive sales nearly 20% in supermarkets during the year ending June 16, 2013. But it wasn’t enough to lift overall sales significantly since the frozen yogurt/tofu segment is relatively small.

Frozen Greek yogurt appeals to consumers for its taste and consistency. Greek yogurt is strained more than regular yogurt to remove much of the liquid whey, lactose and sugar. So without the extra water, frozen Greek yogurt is creamier than regular frozen yogurt.

Frozen Greek yogurt appeals to consumers for its taste and consistency. Greek yogurt is strained more than regular yogurt to remove much of the liquid whey, lactose and sugar. So without the extra water, frozen Greek yogurt is creamier than regular frozen yogurt.

Consumers also prefer it over regular frozen yogurt because it contains more protein. But not all frozen Greek yogurt is meant for those watching their weight.

Though it’s lighter than ice cream, Ben & Jerry’s frozen Greek Yogurt is not intended for consumers on a diet, Jody Eley, brand manager for the company, told SN in February. Each half-cup serving contains between 180 and 210 calories.

Crackers, Cigarettes, Cookies, Soup, Chocolate Candy

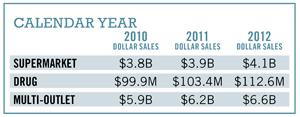

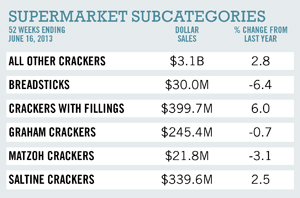

Crackers

Crackers with Filling occupy the top growth spot.

Crackers with Filling occupy the top growth spot.

With a 6% increase in sales during the year ending June 16, 2013, crackers with fillings, like graham and butter cracker sandwiches, are indeed in the lead.

Other growth segments include saltines, achieving gains of 2.5% to $339.6 million in supermarkets.

The constant creation of unique flavor profiles and product reinventions is adding interest to an already thriving category.

The constant creation of unique flavor profiles and product reinventions is adding interest to an already thriving category.

Consider Ritz pretzel flips, a 50/50 mix of traditional butter cracker with a pretzel back.

Some snack makers are doubling down on flavor with savory artisanal style blends like brown rice baked with red bean and parmesan basil or saucing up snacks with sizzlers like salsa, buffalo and jalapeno. Others are showcasing their sweet sides, with graham cracker SKUs in dessert-like flavors.

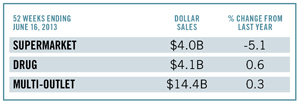

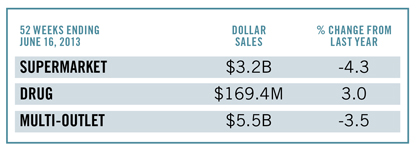

Cigarettes

Cigarette sales have been steadily declining for some time now, and Wells Fargo predicts that volume will continue to take a tumble.

Cigarette sales have been steadily declining for some time now, and Wells Fargo predicts that volume will continue to take a tumble.

During the 52 weeks ending June 16, 2013, sales in the multi-outlet channel are up just 0.3% to $14.4 billion and in drug stores, 0.6% to $4.1 billion, according to market data provided by IRI. In supermarkets, the category was down 5.1% to $4 billion during the same time period.

A series of economic factors may have something to do with the category change. Higher cigarette taxes — like the recently implemented $1.60 tax in Minnesota — may be deterring select smokers. Increased gas prices and the payroll tax hike may also be putting a damper on dollars spent on cigarettes.

A series of economic factors may have something to do with the category change. Higher cigarette taxes — like the recently implemented $1.60 tax in Minnesota — may be deterring select smokers. Increased gas prices and the payroll tax hike may also be putting a damper on dollars spent on cigarettes.

Some believe the slowing may be influenced by the growing popularity of e-cigarettes. While electronic cigarettes were considered just another novelty item until a few years ago, they have come a long way since then, and analysts have gone as far as to predict that electronic smokes might actually surpass traditional cigarettes within the next decade, according to Wells Fargo.

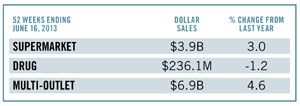

Cookies

According to the National Confectioner’s Association, new and unusual flavors, comfort foods and bite-sized bits are emerging as the 2013 snack trends to meet the ever-evolving appetites of consumers.

According to the National Confectioner’s Association, new and unusual flavors, comfort foods and bite-sized bits are emerging as the 2013 snack trends to meet the ever-evolving appetites of consumers.

Artisan cookie makers have spiced things up with chipotle, picante and jalapeno. Some have also soothed shoppers with herbs like lavender and rosemary, or sweet and savory flavors like salted caramel.

Traditional brands were chopped up into miniature versions of shoppers’ favorites, like chocolate chip and hydrox sandwich cookies, both shrunk to sample size for a fistful of flavorful fun.

Traditional brands were chopped up into miniature versions of shoppers’ favorites, like chocolate chip and hydrox sandwich cookies, both shrunk to sample size for a fistful of flavorful fun.

These innovations, coupled with the American consumers’ continual cookie craving, resulted in yet another year of steady sales increases at supermarkets.

IRI market data shows an uptick in cookie sales of 3% to $3.9 billion during the 52 weeks ending June 16, 2013. Multi-outlet sales were also up, with a 4.6% increase to $6.9 billion during the same time period. Sales in the drug channel, however, dropped 1.2%, settling in at $236.1 million.

Although healthy eaters often steer clear of the cookie aisle, those who choose to indulge are interested in healthful add-ins. Cookies with walnuts, almonds and macadamia nuts are popular. So are those with better-for-you salts, like pink Himalayan salt.

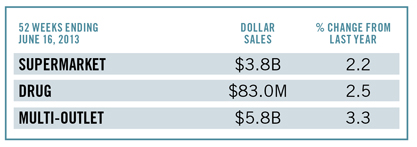

Soup

Sales in the soup category, which includes bouillon, condensed soup, dry broth/stock, dry soup, ramen, ready-to-serve soup and broth/stock, have been relatively flat in recent years, as the same type of shopper remains the top buyer.

Sales in the soup category, which includes bouillon, condensed soup, dry broth/stock, dry soup, ramen, ready-to-serve soup and broth/stock, have been relatively flat in recent years, as the same type of shopper remains the top buyer.

According to Mintel food and drink analyst Beth Bloom, Baby Boomers are the core consumers for this category.

These shoppers increased their purchases during the 52 weeks ending June 16, 2013. IRI data reveal an uptick of 2.2% in supermarkets to $3.8 billion. Drug stores experienced a rise of 2.5% to $83 million and multi-outlet soup sales figures were up 3.3% to $5.8 billion.

After far too many years of decline, Campbell’s set out to launch 32 new soups by this month. It recently introduced Campbell’s Homestyle soups, with wholesome white meat chicken, vegetables and seasoned chicken stock. It will also build on its Chunky Soup line and expand its Go Soups line of premium soups in microwaveable packaging.

After far too many years of decline, Campbell’s set out to launch 32 new soups by this month. It recently introduced Campbell’s Homestyle soups, with wholesome white meat chicken, vegetables and seasoned chicken stock. It will also build on its Chunky Soup line and expand its Go Soups line of premium soups in microwaveable packaging.

According to General Mills, its Progresso Soups have gained a following amongst Baby Boomers and Millennials looking to manage their weight.

Bloom predicts that the growing consumption among this younger group of consumers will be important in maximizing sales and nurturing a loyal user base in the future.

Chocolate Candy

Supermarket shoppers must be craving chocolate candy. All sizes of chocolate boxes, bags and bars experienced sales increases over the past year. So did chocolate gift boxes, novelty chocolate candies and sugar-free chocolates.

Supermarket shoppers must be craving chocolate candy. All sizes of chocolate boxes, bags and bars experienced sales increases over the past year. So did chocolate gift boxes, novelty chocolate candies and sugar-free chocolates.

Dollar sales were up 3.7% overall in supermarkets to $3.3 billion, according to IRI. Like the rest of the confection category, shoppers have flocked to candies with creative infusion like chipotle, jalapeno and picante, heating things up in the boxed chocolate segment during the last 12 months.

Herbs and alcohol have also made the ingredient short-list. Lavender has been perfectly paired with high-end chocolate pieces. Beer has also made a stout companion to the candy, appearing alongside bacon in bars and bite-sized bits.

Herbs and alcohol have also made the ingredient short-list. Lavender has been perfectly paired with high-end chocolate pieces. Beer has also made a stout companion to the candy, appearing alongside bacon in bars and bite-sized bits.

The novelty segment saw a Where’s Waldo 25th anniversary chocolate bar this year while movie-themed treats touted the likes of “The Smurfs,” the cast of “Monsters University” and “Despicable Me Minions.”

The demand for chocolate is increasing here in the U.S. and more so around the world. Scientific American writers Harold Schmitz and Howard-Yana Shapiro report that researchers are racing to fortify the embattled cacao tree as the desire for the decadent candy could soon outweigh the supply of cacao seeds needed to make the sweet treat.

Bottled Juice, Spirits/Liquor, Peanut Butter, Energy Drinks, Premixed Cocktails/Coolers

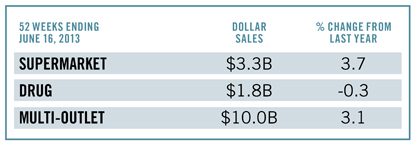

Bottled Juice

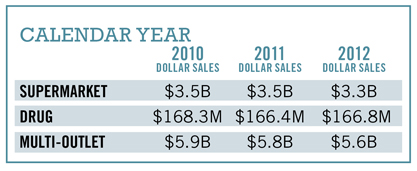

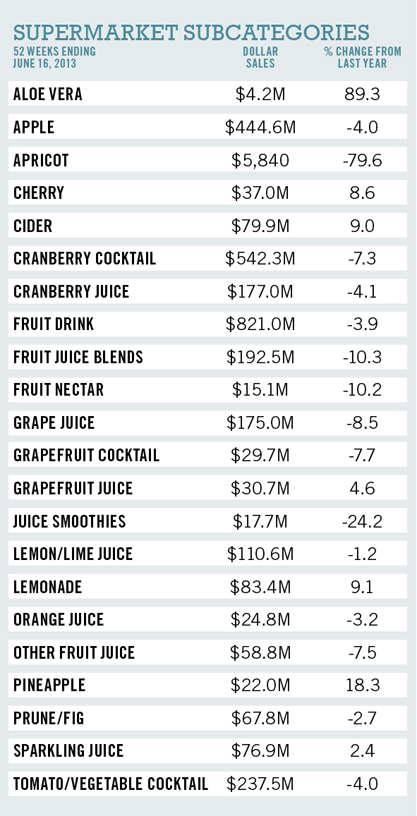

Unique ingredients like aloe vera are keeping bottled juice sales from submerging entirely, as are fresh fruity flavors like pineapple and cherry. But sales are still slumping in the supermarket channel, according to Chicago-based IRI.

Unique ingredients like aloe vera are keeping bottled juice sales from submerging entirely, as are fresh fruity flavors like pineapple and cherry. But sales are still slumping in the supermarket channel, according to Chicago-based IRI.

During the 52 weeks ending June 16, 2013, supermarkets experienced a decrease in sales of bottled juices of 4.3% to $3.2 billion while drug stores captured 3.0% more of the total market share, rising to $169.4 million in dollar sales.

Anything with antioxidants, vitamins, minerals and other functional ingredients have sold well for a number of years now. But shoppers are forever searching for the latest, greatest flavors.

Anything with antioxidants, vitamins, minerals and other functional ingredients have sold well for a number of years now. But shoppers are forever searching for the latest, greatest flavors.

Hence the success of aloe vera juice, which has an unusual taste and marketing claims of aiding in weight loss, easing digestion and boosting immune function. Cherry juice delivers a tangy twist with high levels of antioxidants. And pineapple and apple cider offer vitamins, minerals and sweet flavor profiles.

A recent New York Times article touted the painstaking, decades-old process of cold-pressing as a potential future trend in bottled beverages. While these pressed potions are presently prominent in juice outlets, a select few are pouring into health-centric supermarkets. If they fare well there, they might eventually make it into the mainstream.

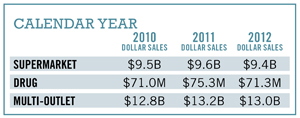

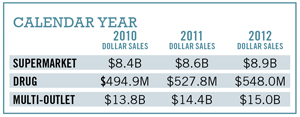

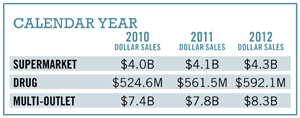

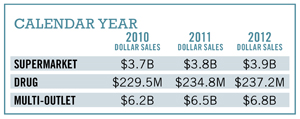

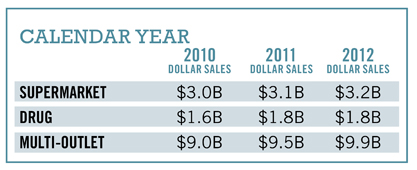

Spirits/Liquor

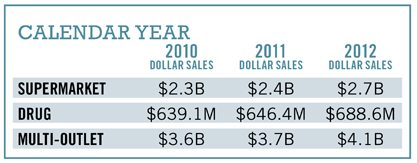

Despite the stubbornly stagnant economy and the influx of wineries and distilleries that sell direct to consumers, retailers are reporting robust sales of wine and liquor. Since 2010, when spirits/liquor sales totaled $2.3 billion in supermarkets, figures have grown steadily, reaching $2.9 billion during the 52 weeks ending June 16, 2013, according to market reports provided by IRI.

Despite the stubbornly stagnant economy and the influx of wineries and distilleries that sell direct to consumers, retailers are reporting robust sales of wine and liquor. Since 2010, when spirits/liquor sales totaled $2.3 billion in supermarkets, figures have grown steadily, reaching $2.9 billion during the 52 weeks ending June 16, 2013, according to market reports provided by IRI.

Manufacturers have mixed things up with flavored vodkas and tequilas. Most were made with the average American consumer’s demand for dessert-like flavors in mind — think vanilla, cotton candy and marshmallow.

At the same time, wine makers have been sugaring up their selections to suit Gen Y shoppers’ sweet palates. This group is continuing to bolster sales in the category, including lower-priced potions that are affordable for daily consumption.

At the same time, wine makers have been sugaring up their selections to suit Gen Y shoppers’ sweet palates. This group is continuing to bolster sales in the category, including lower-priced potions that are affordable for daily consumption.

Some supermarkets are also starting to shelve locally made artisan wines and liquors, tagging onto the buy-local movement.

Industry experts predict that bartenders will forgo the fiery add-ins of last year, like jalapeno, and instead, swizzle spices like cinnamon, cardamom, sage and smoky salt into cocktails in the fall and winter of 2013. In response, liquor makers may roll out savory-spiced infusions for sale in retail stores.

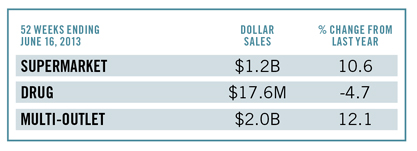

Peanut Butter

Drought and other inclement weather conditions significantly diminished the domestic peanut harvest in 2012, resulting in lower-than-normal supplies of peanut butter.

Drought and other inclement weather conditions significantly diminished the domestic peanut harvest in 2012, resulting in lower-than-normal supplies of peanut butter.

Fortunately, U.S. farmers had increased their total acreage in production by 43%, resulting in carryover stocks of nearly 502,000 tons. This enabled them to double their marketing year in 2013, including sales to peanut butter manufacturers, according to the 2013 Peanut Production Update by the University of Georgia’s Colleges of Agricultural and Environmental Sciences & Family and Consumer Sciences.

Despite the short-term shortage, IRI data showed that sales of higher priced peanut butter were up in supermarkets during the 52 weeks ending June 16, 2013, 0.6% to $1.2 billion.

Despite the short-term shortage, IRI data showed that sales of higher priced peanut butter were up in supermarkets during the 52 weeks ending June 16, 2013, 0.6% to $1.2 billion.

The current surplus of peanuts is expected to drive 2013 prices relatively low compared with prices in late 2011 and early 2012. Savvy manufacturers and retailers could pass their savings along to shoppers, promoting both the peanut butter product and the purveyor.

The 22-member “Peanut Team” at the University of Georgia also suggested pitting peanut butter against other proteins. With meat prices soaring, the group predicts that shoppers will replace a portion of their meat purchases with peanut butter as a penny-pinching protein source.

Energy Drinks

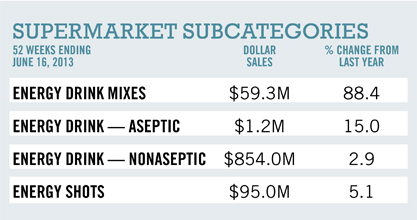

Energy drinks might have the lowest consumption rate of any RTD beverage, but they have had the most dynamic growth in the beverage category for a number of years now.

Energy drinks might have the lowest consumption rate of any RTD beverage, but they have had the most dynamic growth in the beverage category for a number of years now.

According to a recent article in Bloomberg Businessweek, the Food and Drug Administration still isn’t sure whether energy drinks have negative health consequences, but that uncertainty doesn’t seem to be worrying consumers who are, in any case, adept at tuning out health advice from the government.

Even the American Medical Association’s effort to ban marketing of energy drinks to children isn’t having an impact on sales.

Even the American Medical Association’s effort to ban marketing of energy drinks to children isn’t having an impact on sales.

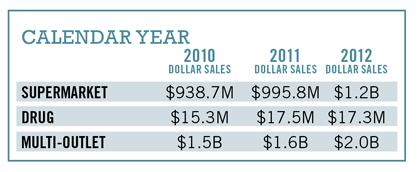

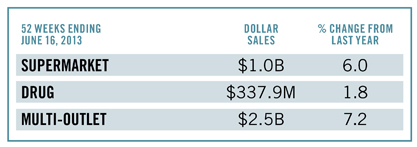

Across supermarkets, drug stores, mass merchants, military commisaries and select club and dollar chains, energy drinks experienced a rise of 7.2% to $2.5 billion with sales in supermarkets and drug stores also going up 6.0% to $1 billion and 1.8% to $337.9 million, respectively.

Monster beefed up its beverages earlier this year by adding protein to its regular energy-inducing ingredients while PepsiCo unveiled Kickstart, a breakfast energy drink. Such product innovations keep consumers coming back for more.

BMO Capital Markets analyst Amit Sharma believes the ongoing energy drink sales spikes are not part of a fad. Because of consumers’ never-ending need for energy, Sharma expects sales to continue trending upward for the foreseeable future.

Pre-Mixed Cocktails/Coolers

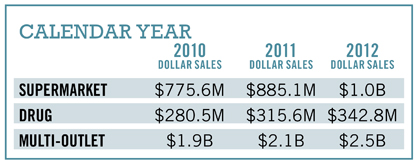

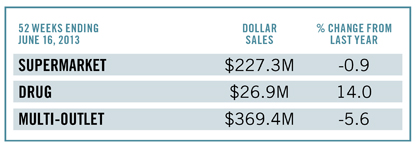

After several years of double-digit sales increases, including a 25% increase during the year ending June 10, 2012, premixed cocktails sales growth plateaued, dropping slightly by 0.9% to $227.3 million in supermarkets during the 52 weeks ending June 16, 2013, according to IRI.

After several years of double-digit sales increases, including a 25% increase during the year ending June 10, 2012, premixed cocktails sales growth plateaued, dropping slightly by 0.9% to $227.3 million in supermarkets during the 52 weeks ending June 16, 2013, according to IRI.

In the multi-outlet channel, sales dropped 5.6% to $369.4 million. Only drug stores showed improvement with a 14% jump to $26.9 million.

Power Brands Consulting reported that the percentage of premixed cocktail makers planning to sell directly to the consumer increased from 25% to 40% this year. As a result, retailers could expect further decline.

A leading libation in the category is the Skinnygirl line, which was recently expanded with Mojito, Sweet 'n Tart Grapefruit Margarita, White Cherry Vodka and Moscato varieties. Aligning with the current low-cal, sweet treat trend, Smirnoff came out with a new Sorbet Light brand in lemon, raspberry pomegranate and mango passion fruit while Malibu introduced Swirl, a coconut rum drink with the taste of strawberries and whipped cream.

A leading libation in the category is the Skinnygirl line, which was recently expanded with Mojito, Sweet 'n Tart Grapefruit Margarita, White Cherry Vodka and Moscato varieties. Aligning with the current low-cal, sweet treat trend, Smirnoff came out with a new Sorbet Light brand in lemon, raspberry pomegranate and mango passion fruit while Malibu introduced Swirl, a coconut rum drink with the taste of strawberries and whipped cream.

Another trend in premixed cocktails involves sweet and fruity wines. Accolade Wines just launched premixed Bellini cocktails in two flavors — Sparkling Strawberry Cocktail and Sparkling Peach Cocktail.

Even singer Nicki Minaj is getting in on the action, partnering with Myx Fusions to create an array of Moscato-based beverages with hints of coconut. peach.

| Suggested Categories | More from Supermarketnews |

|

|

|

|