Channel Migration: A Quest for Affordability

SymphonyIRI's July 11 edition of Times & Trends examines CPG manufacturer and retailer opportunities and risks in a new era of CPG, and explores what the future holds as new formats and new media evolve and gain traction across a rapidly changing consumer marketplace.

August 2, 2011

SymphonyIRI's Times & Trends highlights new developments and critical events across all major CPG categories and channels, providing powerful benchmarking data to help guide your strategic decisions. This edition of Times & Trends examines CPG manufacturer and retailer opportunities and risks in a new era of CPG, and explores what the future holds as new formats and new media evolve and gain traction across a rapidly changing consumer marketplace.

Introduction

In 2007, SymphonyIRI Times & Trends reported a moderation of channel migration trends. Not long after that, the country’s economy took a turn for the worse, and entered what is known today as The Great Recession–the longest and deepest recession since The Great Depression. Since that time, much has changed.

The Great Recession officially ended, and the economy has made some strides toward stabilizing. Some consumers are feeling a modicum of relief to tightly strained budgets. Gas prices fell, then rose again. Despite some leveling off, the average retail price of gas remains significantly higher versus this time last year. And, perhaps most importantly in terms of looking at channel migration trends, retailers across CPG have upped their marketing game.

In the CPG industry, channel lines have definitely blurred during the past couple of years. As strategies, formats and technologies evolve, and as CPG prices continue to rise, this blurring is expected to continue.

Select Findings

Trip mission and associated channel selection patterns are evolving in response to a prolonged economic downturn and high gas and grocery prices. While purchase frequency growth is slowing, overall occasions did climb during the past year, led by drug and dollar stores. Pantry stocking, fill in and special purpose trip missions all experienced frequency declines during this timeframe, while quick trips continue to climb.

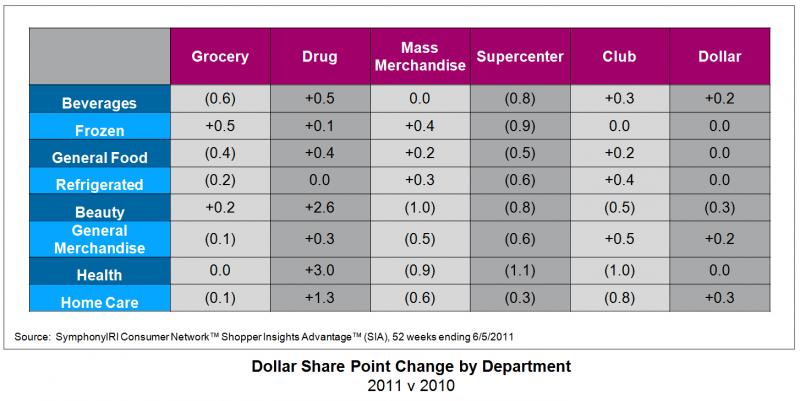

Channel lines are blurring at the department level as competition for share escalates in several major departments. Supercenters have lost share across a number of these departments while grocery and drug are performing quite well. Supercenter marketers are shifting gears in an effort to turn the tides while simultaneously entering new formats and markets.

You May Also Like