Kroger dominant in fragmented field: Analyst

In an environment where “one-stop shopping” for groceries has increasingly become a fallacy, Kroger is still a dominant grocer, according to new consumer research from Wells Fargo Securities.

In an environment where “one-stop shopping” for groceries has increasingly become a fallacy, Kroger is still a dominant grocer, according to new consumer research from Wells Fargo Securities.

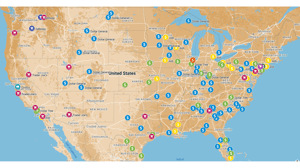

The report, based on a survey of more than 1,000 shoppers in eight markets, showed 34.1% of all consumers citing Kroger (and its associated banners) as their primary place to shop for groceries, well ahead of the next highest finishers Walmart (13.6%); Safeway and its associated banners (10.9%); Trader Joe’s (6.8%); and “other” (5.8%).

Follow @SN_News for updates throughout the day.

Kroger was also cited as the top choice (43.6%) when consumers were asked where else they shop for groceries, although responses to this question revealed a high degree of cross-shopping choices, with warehouse clubs Costco, Sam’s Club and BJ’s Wholesale (38.7%); Walmart (36.5%); Trader Joe’s (35.8%); Target (34.4%); Safeway (31%); Sprouts Farmers Market (30.7%); and Whole Foods Market (27.2%) also mentioned.

“Only 2% said they do not shop anywhere else for groceries, suggesting that most consumers are willing to shop multiple grocery stores to get what they want,” the report, written by Wells Fargo senior analyst Kate Wendt, said.

Kroger’s dominance among grocers was illustrated by it being cited as the most cross-shopped store by primary Safeway shoppers; while Safeway ranked behind Walmart, warehouse clubs and Target among primary Kroger shoppers.

“This may suggest more loyalty among Kroger shoppers,” Wendt wrote. “[I]f consumers consider Kroger their primary shop, that’s their most highly shopped traditional grocery store by a good margin; if consumers consider Safeway their primary grocery store, more seem to also defect to shopping at Kroger when they can.”

Kroger was also the top cross-shopped store among those who considered Sprouts and Trader Joe’s their primary shop, the report said. Those who cited Whole Foods as their primary store cross-shopped most at Trader Joe’s, which Wendt said supported Whole Foods’ contention that Trader Joe’s was its most important foe.

About the Author

You May Also Like